Wrapped Staked Ether (wstETH) is currently trading at $3,982.77 – a 7.8% surge in a day, while Ethereum (ETH) is priced at $3,359.14. That’s a difference of $623.63, and here’s why.

The history of wstETH dates back to the launch of the Lido protocol, which allows users to stake their ETH and receive stETH in return. Staking ETH means locking it up to help secure the Ethereum network, and in return, stakers earn rewards.

However, stETH can’t be easily traded or used in DeFi, so Lido introduced wstETH, a “wrapped” version that maintains staking rewards while being more liquid and usable across DeFi platforms.

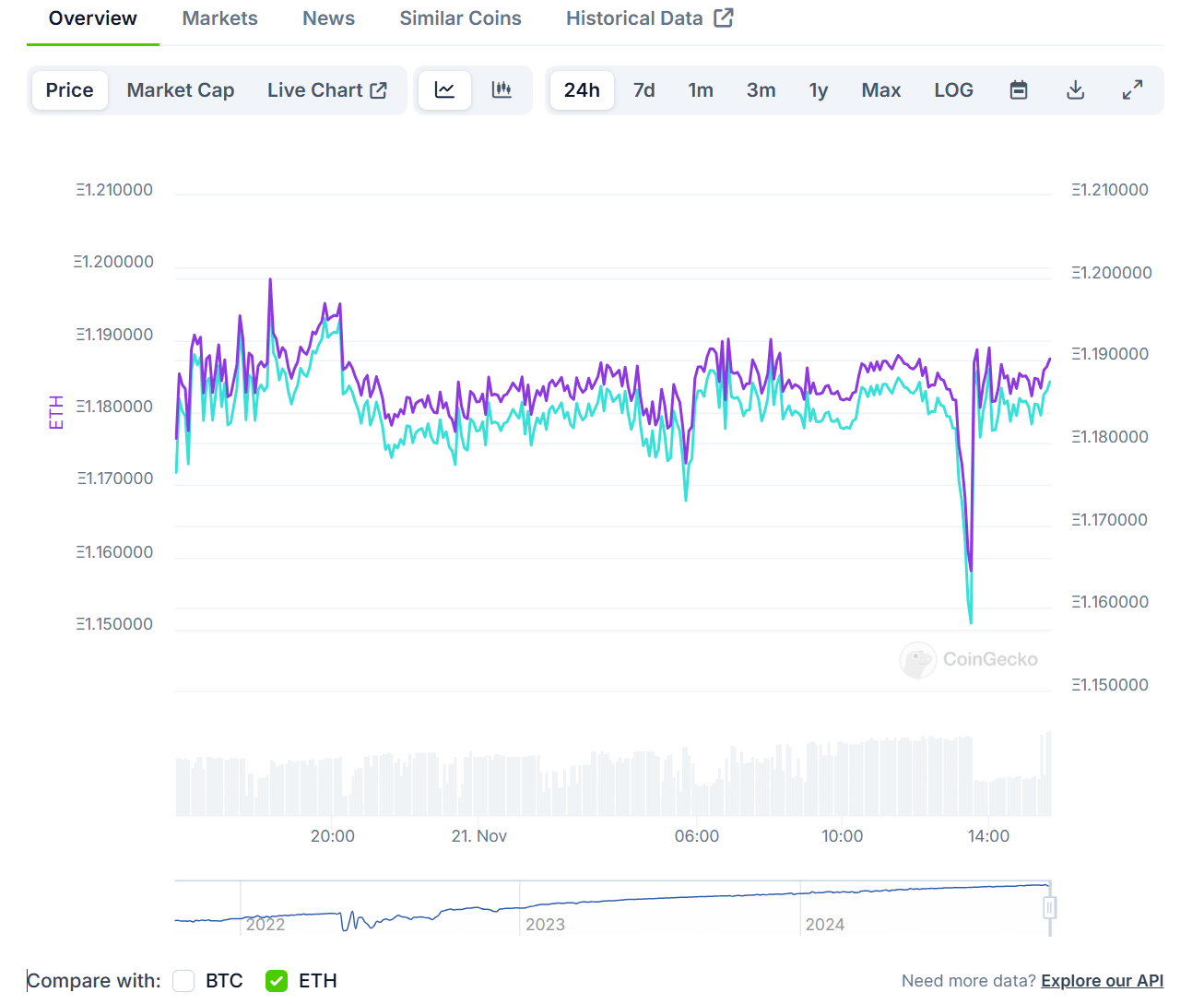

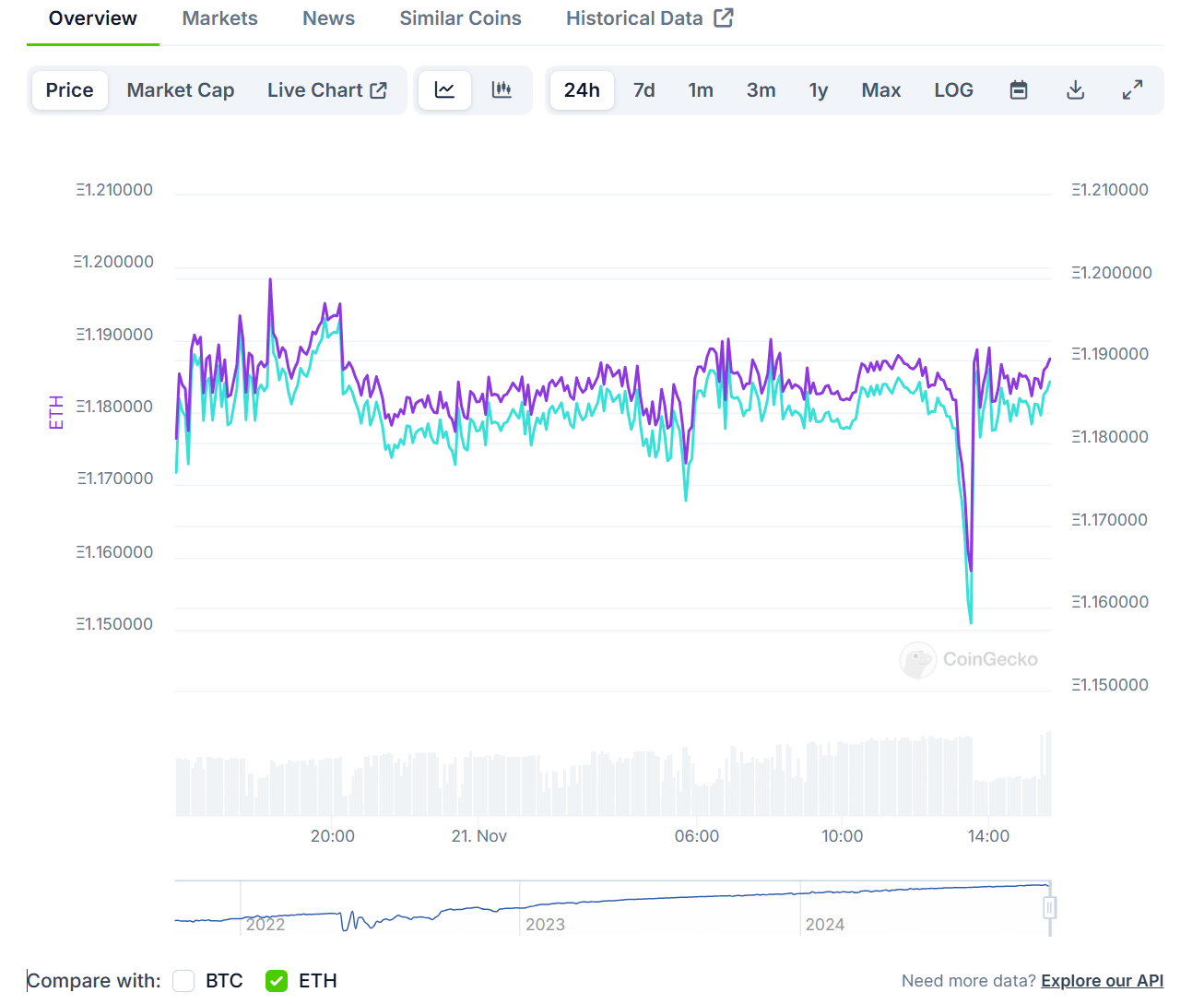

According to CoinGecko, the exchange rate of stETH to ETH has remained near parity, with a slight deviation of approximately 0.03%.

Looking at the bigger picture, Ethereum has a market cap of $405 billion, making it one of the largest cryptocurrencies in the world. However, wstETH’s market cap, on the other hand, is much smaller at $14.42 billion.

This makes sense because wstETH only represents the portion of ETH that has been staked through the Lido protocol. It’s not meant to compete with ETH’s massive scale but to serve a specific purpose for stakers.

Additionally, ETH’s 24-hour trading volume is $6.5 billion, while wstETH’s is just $50 million. This is because ETH is widely traded across many platforms, while wstETH is mostly used by people involved in DeFi activities like borrowing, lending, or farming additional rewards.

In short, wstETH is perfect for those who want to stake their ETH and earn rewards without locking it up. It’s like having the best of both worlds, you can put your ETH holding to work and still use it whenever you want. That’s why it’s growing in popularity, even if it’s not as widely traded as Ethereum itself.

Also Read: Why Ethereum Could Outperform Bitcoin and Reach $10,000?