Since its inception, the crypto scene has been dominated by Bitcoin on a larger scale. Bitcoin Dominance (BTC.D) is a crucial metric that measures Bitcoin’s share of the total cryptocurrency market capitalization. It serves as a barometer for Bitcoin’s influence in the market and help investors understand market trends and capital shifts.

Whether it’s predicting the rise of altcoins or gauging investor sentiment, BTC dominance always plays a pivotal role in shaping market dynamics. This article explores what BTC dominance is in detail, what impact it has on the broader crypto market and what happens when it moves either way. Let’s get into it;

What is Bitcoin Dominance?

Bitcoin Dominance is Bitcoin’s market share in the whole crypto market capitalization. It is calculated by dividing Bitcoin market capitalization by the total market capitalization of all cryptocurrencies and multiplying it by 100.

For example: If Bitcoin’s market cap is $500 billion and the total crypto market cap is $1 trillion, BTC dominance would be: BTC Dominance = (500 billion / 1000 billion) × 100 = 50%

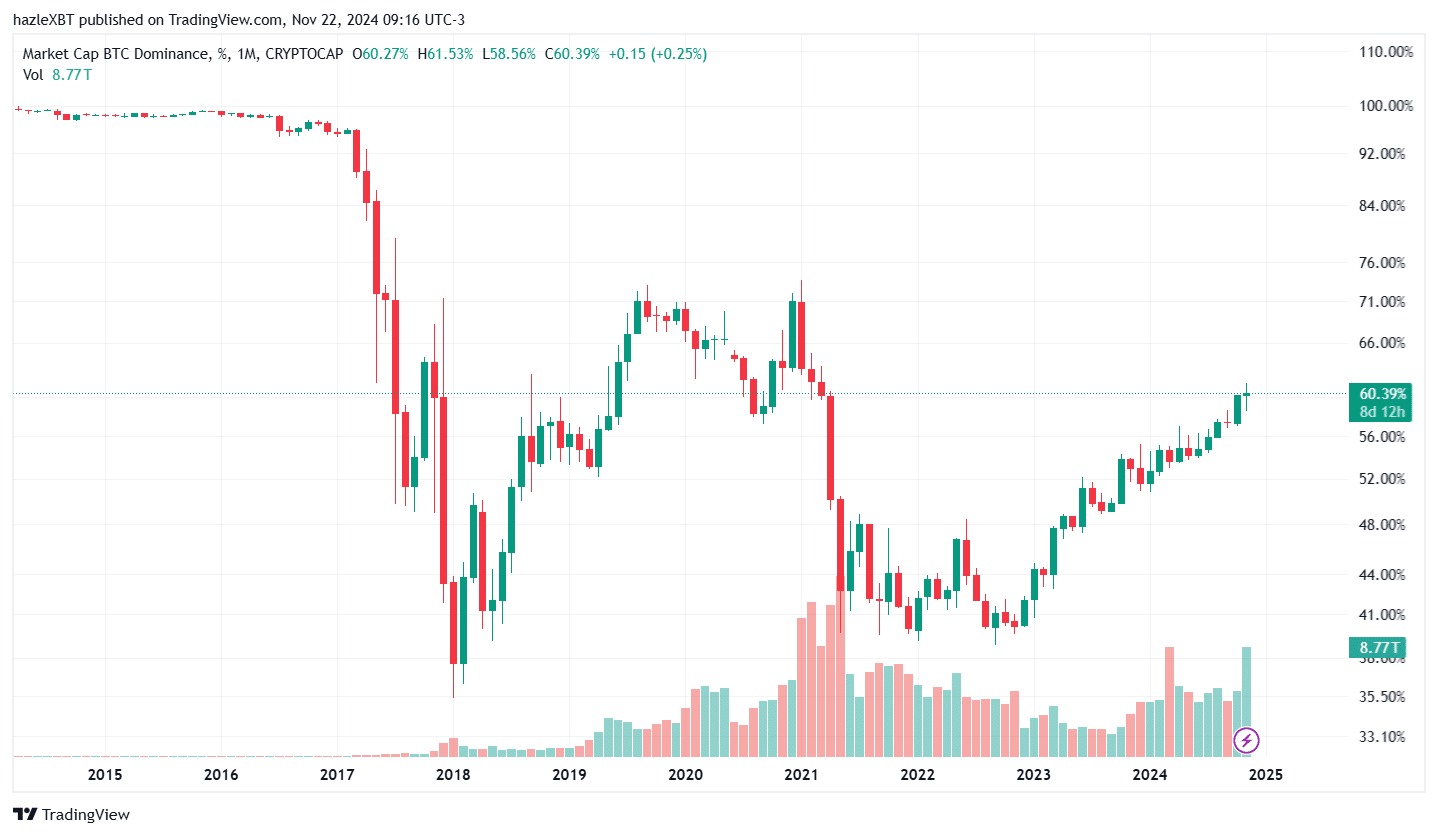

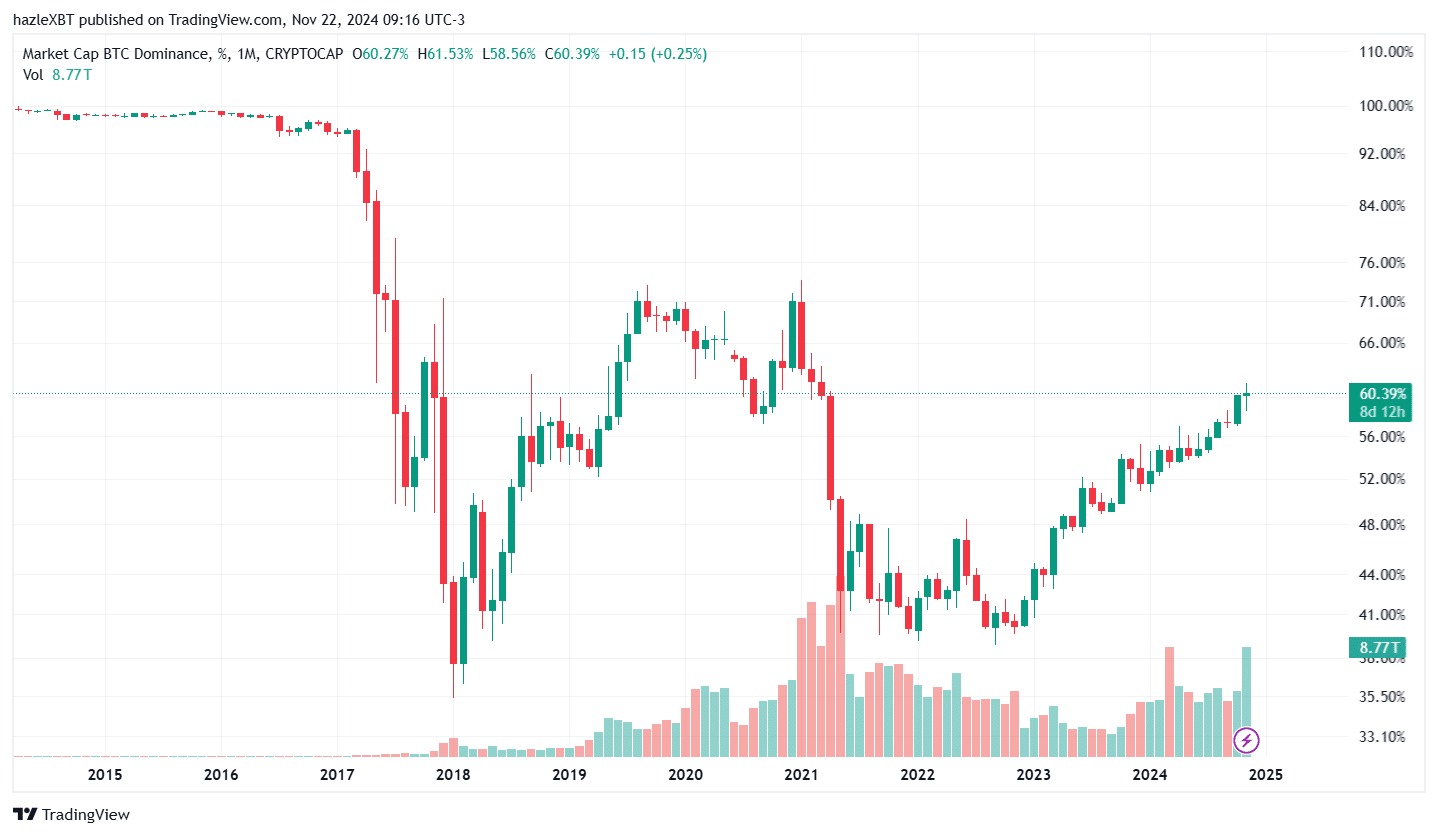

This metric highlights Bitcoin’s standing as the leading cryptocurrency and serves as a barometer for its influence in the market. Historically, Bitcoin dominated over 90% of the market in its early years but with the rise of altcoins like Ethereum, Ripple and Solana, its dominance has witnessed major ups and downs over years.

The current Bitcoin dominance is around 60% – which means that Bitcoin accounts for 60% of market share in the total cryptocurrency market capitalization, valued at $3.3 trillion. According to data provided by Coinmarketcap, the Bitcoin market capitalization currently stands near $1.95 trillion.

How Bitcoin Dominance Impacts Crypto Market

Bitcoin Dominance plays a critical role in shaping the dynamics in the crypto industry. It has been seen as a key indicator for upcoming trends like bitcoin bull run, alt-season and crypto capital rotation. It essentially acts as a gauge for where market participants are focusing their attention and funds. Following are few key areas where Bitcoin dominance becomes much important;

High Bitcoin dominance usually signals that investors prefer Bitcoin as a safer or more stable option, especially during uncertain times. This can mean reduced speculative interest in altcoins.

When Bitcoin dominance rises, altcoins often underperform as more capital flows into Bitcoin rather than other cryptocurrencies. Vise versa, it suggests a stron demand for Altcoins over Bitcoin when dominance decreases.

A decrease in BTC dominance indicates a higher risk appetite among investors. In such times, investors usually allocate a high amount of funds for higher-risk higher-reward altcoins.

What Happens When Bitcoin Dominance Decreases

Bitcoin dominance witnesses a significant drop when capital flows out from Bitcoin and relocates within altcoins. In this phase, the altcoin market grows disproportionately faster while Bitcoin takes rest and keeps up with mild market movements.

The chart above gives a clear view that when Bitcoin dominance has decreased, the altcoin market cap has witnessed a remarkable surge. The first major surge in altcoin market cap occurred between 2016 to 2018 when Bitcoin price spiked above $10,000 for the first time. The second sharp increase in Altcoin happened right after Bitcoin broke to new all-time high of $63,500 in April 2021.

In such times when Bitcoin dominance decreases, altcoins experience massive price gains as traders shift their focus to them. It also increases market volatility as most of the short-term investors re-allocate their capital to alternate crypto assets in mass.

The decrease in Bitcoin dominance also diminishes Bitcoin’s role temporarily as the primary driver of the crypto market. This suggests that a sharp drop in Bitcoin dominance is not always positive as it gives a signify warning that interest in Bitcoin or the wide crypto market has not been sustained.

What is Altseason and How it concerns Bitcoin Dominance

Altseason, short for “altcoin season,” refers to a period when altcoins significantly outperform Bitcoin in terms of price growth and market share. This phase usually occurs after investors book profit from Bitcoin’s price gains and shift their capital to altcoins. It is also a common occurrence during bullish market cycles.

Additionally, altseason could also be triggered by sudden technological advancements such as the launch of innovative projects or major upgrades in DeFi space. One of the key indicators of altseason includes top altcoins like Ethereum (ETH) outperforming Bitcoin.

Altseason also brings a notable surge in the market caps of smaller altcoins while heightening social media buzz around new and emerging crypto projects.

Conclusion

Bitcoin Dominance is a powerful indicator that provides insight into the health and trends of the cryptocurrency market. When the dominance is high, Bitcoin typically leads the market but when the dominance declines, it can signal the onset of altseason – where altcoins take center stage. Understanding these dynamics helps traders and investors make informed decisions and capitalize on market opportunities.

Also Read : Next Bitcoin: Which Cryptocurrency Holds the Greatest Potential?