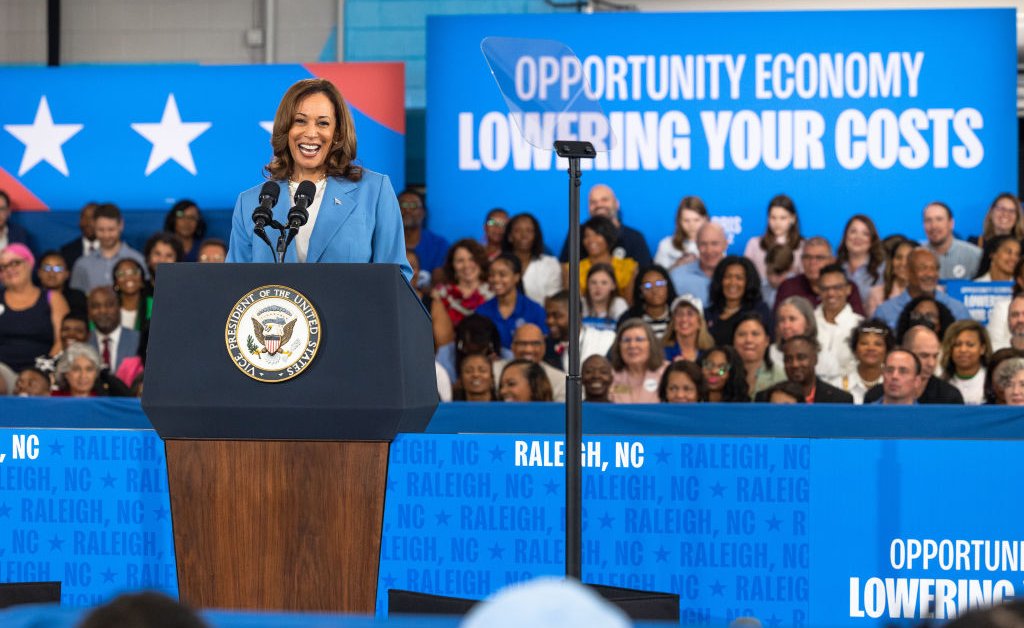

On the campaign trail, Vice President Kamala Harris is pitching herself as a champion of the middle class, arguing that her economic policies will provide relief as inflation and rising living costs dominate voters’ concerns.

Her strategy involves banning price gouging, promoting housing affordability, reducing healthcare costs, and revising former President Donald Trump’s signature tax cuts that economists say benefitted corporations and higher-income taxpayers. “We will create what I call an opportunity economy,” Harris said as she accepted the Democratic nomination for President. “An opportunity economy where everyone has a chance to compete and a chance to succeed.”

Read More: What Kind of President Would Kamala Harris Be?

Trump is casting her policies as radical and too far left, and some economists worry that the implementation of her proposals could lead to labor market disruptions and uncertainty for businesses. Harris is framing herself as a capitalist who believes in an “active partnership between government and the private sector.”

Here’s what to know about Harris’ economic plan if she were to win the presidential election.

Promote affordable housing

With interest rates on the rise, many Americans are feeling the pinch when it comes to homeownership. The current landscape has created a scarcity of housing options for potential buyers, as those with favorable mortgage rates are hesitant to sell.

Harris’ plan includes providing up to $25,000 in down payment assistance for first-time homebuyers, which her campaign estimates could help approximately 4 million Americans secure homes over the next four years. The plan would also provide a $10,000 tax credit for first-time homebuyers. The nonpartisan Committee for a Responsible Federal Budget (CRFB) estimates that the first-time home buyer credit would raise the federal deficit by at least $100 billion over 10 years.

Read More: What a $25k Down Payment Aid From Harris Could Really Mean For First-Time Homebuyers

Harris has also proposed building 3 million new housing units by providing a first-ever tax incentive for builders of starter homes targeted at first-time buyers, and by creating a $40 billion “innovation fund” to help local governments build more affordable housing. Harris would also expand an existing tax incentive for building affordable rental housing.

Some economists, however, fear that her plan will boost demand before supply can catch up and put even more pressure on prices. “I think it would benefit homeowners as opposed to homebuyers,” says Carl Schramm, an economics professor at Syracuse University.

Harris’ housing plan also includes proposals to lower rent costs by blocking landlords from using algorithm-driven price-setting tools to set rents and removing tax benefits for investors who buy large numbers of single-family rental homes.

Reduce healthcare costs

A Harris presidency would likely build on the Biden Administration’s efforts to reduce healthcare costs. She has proposed a number of measures aimed at helping Americans save on treatment, such as by expanding the federal government’s authority to negotiate drug prices, extending tax credits to offset insurance premiums, and expanding healthcare benefits to cover at-home senior care.

Harris is calling to expand the current $35 monthly cap on out-of-pocket costs for insulin and the upcoming $2,000 annual cap on out-of-pocket prescription drug expenses to all Americans, not just seniors on Medicare. Now that Medicare can negotiate prices directly with drugmakers—a key feature of Biden’s Inflation Reduction Act—Harris has vowed to speed up those negotiations so that the costs of more medications come down faster. The Biden Administration recently announced the first round of negotiations, which is expected to reduce out-of-pocket costs for seniors by $1.5 billion when the lower prices take effect in 2026 and result in $6 billion in savings for Medicare.

Read More: What a Donald Trump Win Would Mean for the Economy

Harris said that she would use some of those savings to establish a “Medicare at home” program that would cover long-term home-care services (such as in-home aides) so that seniors can get support without going to a nursing home. The plan is part of her pitch to middle-aged voters who are grappling with the dual cost of raising children and attending to their aging parents. “I took care of my mother when she was sick. She was diagnosed with cancer,” Harris said in an interview on ABC’s “The View” on Oct. 8. “There are so many people in our country who are right in the middle. They take care of their kids and they’re taking care of their aging parents, and it’s just almost impossible to do it all,” she said.

Raise taxes on the wealthy

With provisions of Trump’s signature tax cuts set to expire in 2025, the next President will play a significant role in the upcoming tax fight. Harris’ plan involves tax cuts for lower- and middle-income households, particularly through expansions of the child tax credit and earned-income tax credit.

Her proposals mimic those outlined by Biden’s most recent budget proposal, which would raise nearly $5 trillion in new revenue over a decade by raising taxes on the wealthy and large corporations. She supports increasing the corporate tax rate to 28% from its current 21%, a move projected to bring in around $1.4 trillion over the next decade, according to estimates by the CRFB. Some economists, however, have warned that low corporate taxes are necessary to keep the U.S. competitive and a desirable place for multinational companies to do business.

Harris has also suggested raising the long-term capital gains tax rate to 28% for individuals earning over $1 million, up from the current 20% rate but down from President Joe Biden’s proposed 39.6%. She would also impose a wealth tax on taxpayers with a net worth of at least $100 million, but has pledged not to raise taxes on any household earning less than $400,000 annually. Like Trump, Harris has also promised to end federal income taxes on tips.

Harris would use the new revenue from raising taxes on corporations and wealthy individuals to help pay for other measures on her wish list, such as adding a new child tax credit of up to $6,000 for families in the first year of a child’s life. The new credit would build on the Biden Administration’s temporary expansion of the child tax credit during the pandemic, which research found reduced child poverty. Harris would also restore the American Rescue Plan’s expansion of the child tax credit to as much as $3,600, up from $2,000. It had been set at $3,000 per child before its expiration at the end of 2021.

Andrew Lautz, associate director for the Bipartisan Policy Center’s economic policy program, says that Harris’ tax plan is “progressive in nature” and would deliver a “larger proportion of benefits to low- and middle-income families than to high income families.”

Raise the minimum wage

Harris has advocated for a higher minimum wage and eliminating the tipped minimum wage, which is currently set at $2.13 an hour federally.

Speaking to reporters on Oct. 21, the Vice President described the current minimum wage as “poverty wages” and added that it must be raised, although she did not specify the exact amount she would raise it. The minimum wage is currently set at $7.25 an hour federally.

A study by the Congressional Budget Office (CBO) released in December 2023 found that raising the federal minimum wage to $17 an hour by July 2029 could increase wages for more than 18 million people, but also put about 700,000 Americans out of work. Separate CBO data shows that raising the minimum wage would boost deficits by roughly $50 billion over a decade.

Ban price gouging

To combat high prices, Harris has proposed a ban on price gouging by food suppliers and grocery stores, an initiative intended to mimic existing state laws that prevent drastic price hikes during emergencies. While progressive Democrats have embraced the proposal, it has faced pushback from Republicans and many economists who liken it to Soviet-style price controls.

The Harris campaign has not announced the specifics of how the ban would be enforced, and it would require cooperation with Congress in order to become law. Dozens of states already have laws that ban price gouging, but there’s currently no federal law against it.

Jason Furman, a top economist in the Obama Administration, told the New York Times that the corporate price gouging ban could lead to a shortage of goods as companies might have less of an incentive to enter the market, particularly if their profit margins would be lower. “This is not sensible policy, and I think the biggest hope is that it ends up being a lot of rhetoric and no reality,” Furman said. “There’s no upside here, and there is some downside.”

The causes of food inflation are complex; some policy experts have pointed to price gouging as a contributor, but it has also been linked to higher energy costs, increased labor costs at manufacturers, extreme weather, and more.

No Trump tariffs

On the issue of trade, Harris has sought to distinguish herself from Trump while also recognizing the need for protectionist measures in certain circumstances. She has been critical of Trump’s proposed tariffs, labeling them a “reckless national sales tax” that could cost middle-class families thousands of dollars annually.

Harris has yet to fully outline her philosophy on tariffs, but has expressed a commitment to protecting domestic industries from foreign competition. Robert Lawrence, a professor of trade and investment at Harvard University’s Kennedy School of Government, says that Harris might continue Biden’s targeted tariffs on Chinese imports, citing national security concerns, but her tariff plan remains unclear. “She’s sort of avoided making commitments as to whether she would simply continue with the Biden approach,” he says.