Uniswap’s (UNI) price is on a roll, climbing steadily for five days straight. On Monday, November 25, the token hit $12.37, its highest since April 1. That’s a massive 150% jump from its lowest point earlier this year.

However, Analysts believe this momentum could carry the price even higher in the coming months. Cryptocurrency influencer Anasta Maverick, who has over 26,000 followers on X, believes UNI could reach $17.70 soon, which would mean another 50% gain.

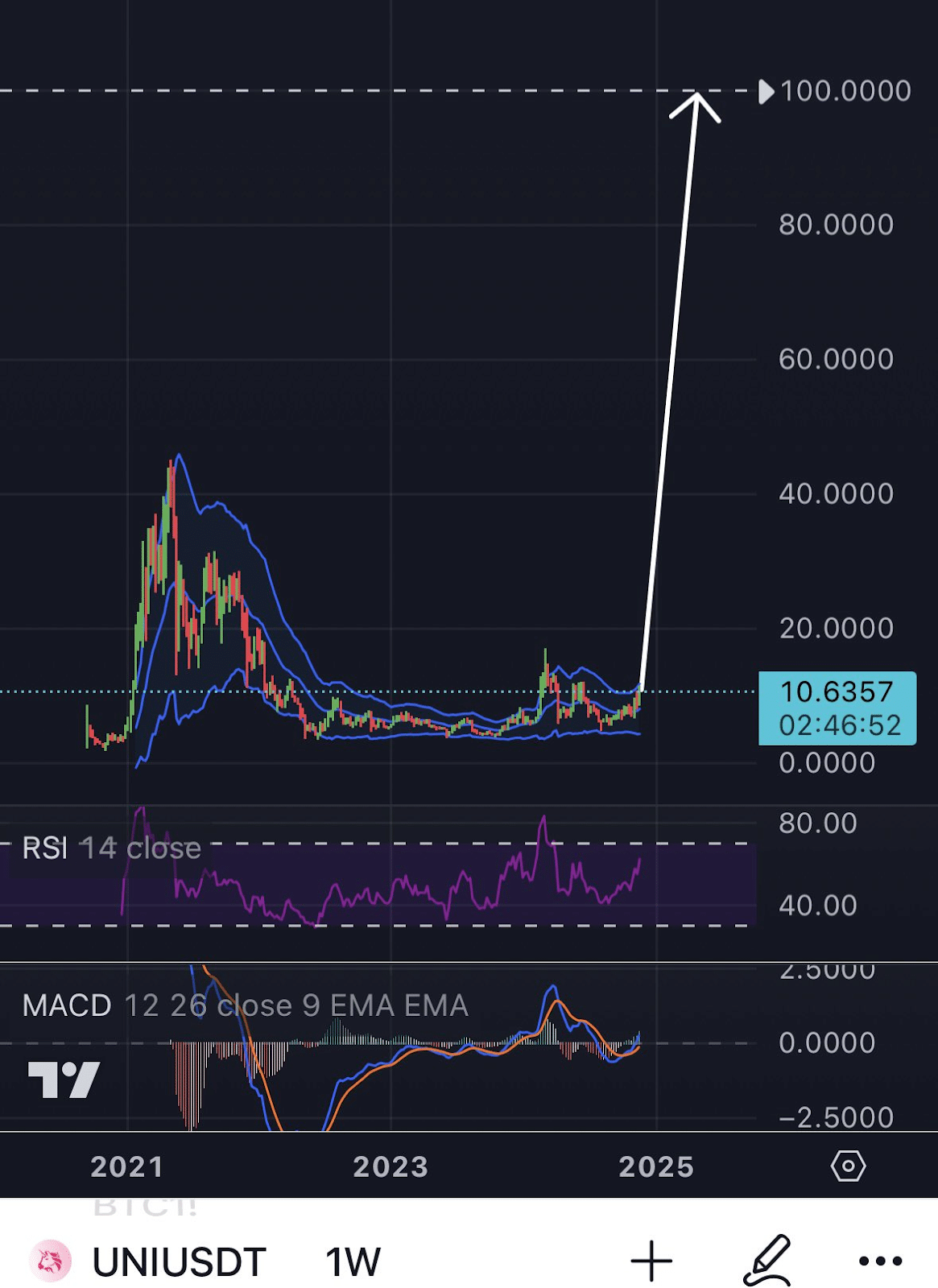

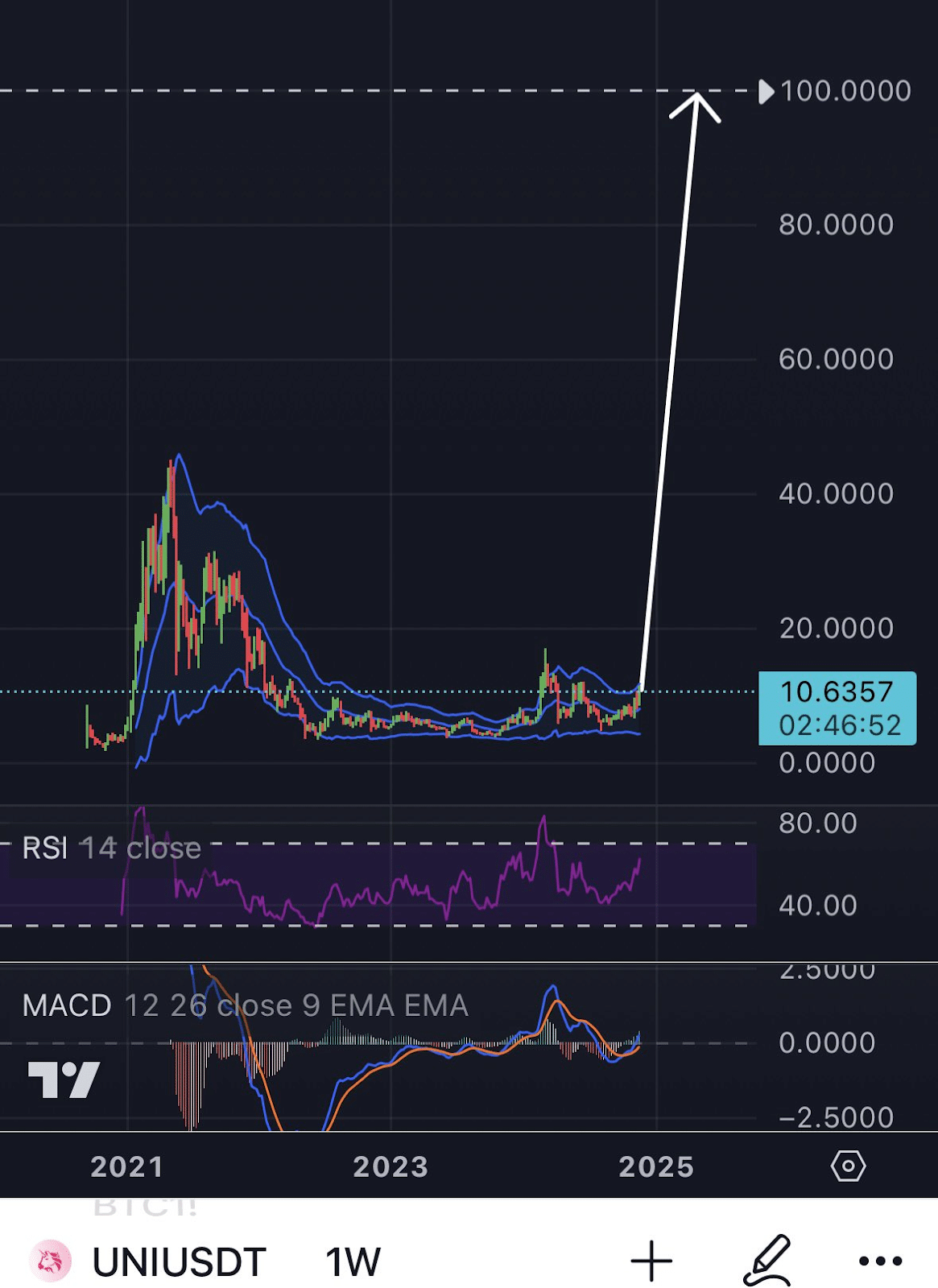

Another analyst, HypeManAlex, noted that the token might surge to $100, representing a 733% increase. He attributed this optimism to Uniswap’s dominance in the decentralized exchange (DEX) space.

Moveover, Uniswap has processed more than $1.54 trillion in transactions since its launch, including $81.7 billion in the last 30 days alone. In the past week, the platform handled $26 billion in trading volume and operates across more than 20 blockchain networks.

Meanwhile, its competitor, Raydium, processed $26.86 billion in trading volume over the same period and $231 billion in total volume to date.

Adding to Uniswap’s momentum is its upcoming layer-2 scaling solution, Unichain. Currently in the testnet phase, Unichain aims to address scalability issues and compete with Ethereum, Solana, and Arbitrum. The public mainnet for Unichain is expected to launch by late 2024 or early 2025.

Despite these bullish developments,there are still major c. According to Etherscan data, Whale activity has shown significant sell-offs, with one whale moving 466,000 UNI tokens worth $5.4 million to OKX, while another transferred $1.29 million worth of tokens to Coinbase. Such moves may soon signal potential selling pressure.

Also Read: CHILLGUY spikes over 60% in 24h: Binance Listing Ahead?