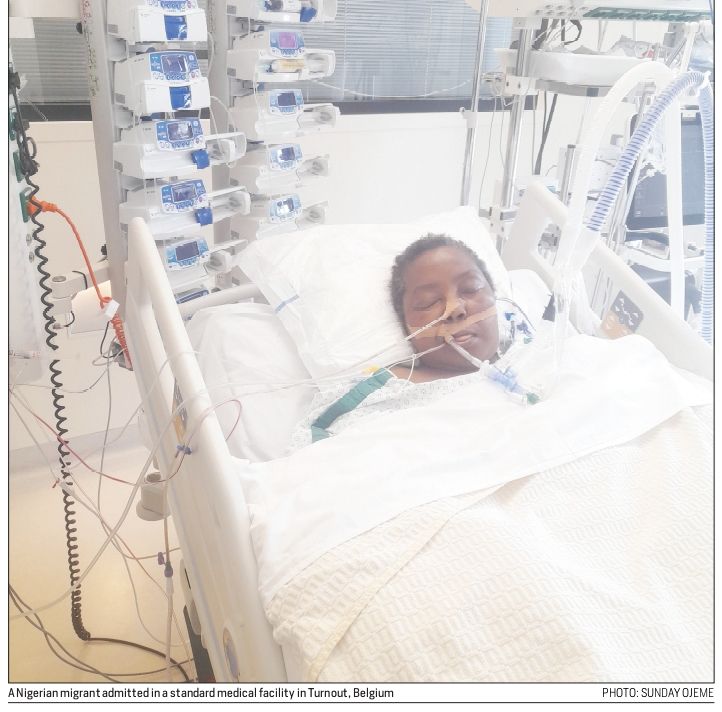

In this era of growing migration for economic and socio-political reasons, there is an urgent need to embrace available opportunities in travel insurance in order to share risks associated with such journeys, especially due to unforeseen circumstances and climate change, SUNDAY OJEME writes

Leaving life to chance

At the expansive and busy central location around Boulevard Leopold 11 in Brussels, some black boys and girls from Africa clustered around a young man obviously in his mid twenties.

Looking dazed, weak and tired, the boy, who was later discovered to be a Ghanaian, held a bottle of water, a roughly eaten burger with the content dropping as he walked, dragging himself closely between a lady and one other boy while others walked behind.

Tired and worn out, he begged to be allowed to take a rest, not quite long after leaving the first place where he had sat for over three hours trying to gain some strength.

A closer observation and some interactions by this reporter revealed that Samuel, a recent migrant from Ghana, was seriously sick with headaches and a bout of fever, which his friends simply concluded to be malaria.

Looking weak and feeble, the empathy for him was deep, but being in Europe one would have expected those with him to either call an ambulance for help or rush him to the nearest hospital for proper medical attention.

On a closer interaction with the unkempt, dreadlock and ear rings bearing youngsters, it was discovered that Sam, as he was fondly called, would rather confront his fate by indulging in self-mediation than be taken to any government hospital for treatment. The reason for this was obvious.

According to findings, he made his journey to Europe through the dreaded North African route by sea to Italy before finding his way to join his friends and kinsmen in Belgium without the necessary travel documents including a travel insurance cover.

For fear of not being detected or not having enough money to cover his hospital bills, Sam’s team of friends, who have also been in Europe illegally for sometime before him, would rather advise he towed the path of self-medication than risk exposing himself to the authorities or searching for money where there is none for expensive hospital bills.

Findings also revealed that the experience on that sunny day in July was the fifth since he achieved his dream of relocating from his Tamale community in Ghana to the western world for greener pastures.

For treatment under such condition, one of them, Addae, said they relied strictly on buying drugs directly from local shops by simply relying on the experience back home.

In situations where they manage to get any of them to the hospital, they end up paying far more than what it would have cost them to receive better medical attention if only the person got the requisite travel insurance document before embarking on the trip.

While the risks associated with traveling without insurance remain enormous, the rate of migration recently appears not to be waning.

Sam’s experience is a replica of what migrants without proper insurance go through in some countries they travel to.

The situation goes beyond medical expenses to include distress faced when luggages are missing, flight cancelations, delays and in worse cases, death.

Having a cover for the journey

For emphasis, Sam’s case contrasts with that of a Nigerian, Ayodele Suraji, who traveled to the Netherlands for a short course.

On his part, Suraji traveled to the Netherlands for the first time in 2022 for a programme as a professional in the maritime sector.

Also in his 20s, having been offered the opportunity by his organisation, he got himself fully prepared and equally armed with a travel insurance with sum assured of up to €30, 000.

On his arrival, his contact with the cold environment stirred a bout of fever that has been inside his body for months without manifesting probably due to resistance from his natural acquaintance with African weather and long drug use.

Unable to resume with his colleagues due to the breakdown, the programme director referred him to one of the hospitals specifically for foreigners.

According to him, signs of the sickness started manifesting the moment he touched down at Schiphol Airport in Amsterdam. Subsequently, the journey from Amsterdam to Rotterdam where the training would take place appeared to have increased the sickness.

“Being my first time to travel that distance, I initially thought it was due to jet lag. However, the truth dawned on me the following day when I could not resume lectures with my colleagues.

“I got a call from the course director, who eventually directed me to a particular hospital. When I met the receptionist the first question he asked me was if I had an insurance.

I didn’t just get the message because I was too weak and thought he should have seen me as an emergency rather than bother me with questions. “At that point I located a spacious chair around and fell on it and had to lie down.

I was too weak for any type of drama but suddenly, a lady emerged from one of the rooms and called my name. That was the point I managed to stand up and was ushered into a room where blood and all sorts of samples were taken.

“After about three hours I was wheeled to an elevator and taken to the ward on admission, where I spent about five days, treated and discharged.

“It was later I got to realise that my travel documents included an insurance for my medical care throughout the period I would be there,” he said. As it is in the Netherlands, the same applies to so many other countries in Europe and elsewhere.

Specifically, the Dutch Government specifically instructs that those planning to live or work in the Netherlands for at least four months, as well as those who need a Schengen visa, are required by Dutch law to buy insurance.

For all other visitors, the government does not require travel insurance – but it will help you avoid large medical bills. Wider opportunities to enjoy Travel insurance covers so many things apart from medical expense.

It is one of the basic insurance policies that have largely taken care of expensive and unforseen risks with regard to international travels and, in some cases, local trips as well.

Besides medical expenses, travel insurance also covers lost or damaged luggage, flight cancelations, trip delays, personal injury and death.

With the growing rate of migration into a life of uncertainty lately due to economic challenges, the need for travel insurance has become unarguably indispensable.

Due to the rise in passenger traffic and climate change, the risk of losing one’s luggage or being afflicted by one ailment or another is becoming very obvious.

Baggage losses, delayed and canceled flights

According to Sita’s latest baggage insights report, the number of bags that were delayed, lost or damaged jumped to 7.6 pieces of luggage per 1,000 passengers in 2022.

This was the highest rate since 2012 when the overall figure was 26.3 million – nearly nine pieces mishandled per 1,000 passengers. A report by the Nigerian Civil Aviation Authority had also revealed that about 2,000 air passengers lost 19,274 pieces of luggage between January and June this year.

According to the report, 19,250 passengers were delayed for long hours during the review period. Nigerian air passengers, like others elsewhere, face challenges including loss of personal belongings and various frustrations that demand compansation.

They experience delayed or abrupt cancellations of scheduled flights at various airports severally.

Details of NCAA’s statistics showed that 35,398 flights operated by 13 local carriers experienced 16,945 delays, while 26 international airlines had 2,305 flight delays out of the 7,144 flights operated within the same period.

The 13 domestic carriers cancelled 696 flights within the period, representing two per cent of the total 35,398 flights operated by the airlines.

The data indicated that 48 per cent of total local flights were delayed by domestic operators with Dana Air getting the highest number of delays. It recorded 69 per cent flight delays, as the airline delayed 999 flights out of a total of 1,446.

Giving his experience in a chat with our correspondent, an activist, Mr. Matthew Oghogho, who lost his luggage during a trip between Geneva and Belgium, said he would have been compensated by his insurance company if only he had included loss of baggage to his medical cover.

According to him, “I traveled to Geneva from Nigeria for the ILO conference in 2023. After the conference I decided to visit my friend in Belgium, but somehow, the bus I traveled in left me behind at a point we were asked to come down to refresh.

“I didn’t know we had just 10 minutes for that because the driver was speaking French, which I don’t understand. When I was done I came out and noticed that the bus had left with my luggage.

All efforts to trace the luggage were futile because I had just a little time to stay before my visa expired. “I came back to Nigeria and was communicating with the bus company, BlablaCars, before I got tired and gave up.

I complained to the insurance company that covered the trip and they said loss of luggage was not included in the cover, otherwise, they would have investigated then compensate me. “I think it is a lesson for me to know what to request for when next I need to travel.

Growing migragtion

A recent report by the International Labour Organisation (ILO) revealed that international migrants had become a vital force in the global labour market.

According to ILO, “international migrants are playing a crucial role in the global economy and made up 4.7 per cent of the total global labour force in 2022, with most employed in high-income countries and in key sectors such as services, notably care provision.

“Migrants faced a higher unemployment rate (7.2 per cent) compared to non-migrants (5.2 per cent), with migrant women (8.7 per cent) experiencing higher unemployment levels than men (6.2 per cent).”

Why migrants, who easily access employment can be excused from the medical expenses distress as their employer would have provided that for them, the ones without jobs face the double jeopardy of having to feed from what they have left and also pay their expensive medical bills in the event of not being properly insured before leaving their countries.

While the risks associated with traveling without insurance remain enormous, the rate of migration recently appears not to be waning.

A new report emanating from the United Kingdom revealed that more than 150,000 migrants arrived in the UK after crossing the Channel in the last seven years.

According to the report, since the current records began on January 1, 2018, 150,243 people have made the journey, according to PA news agency analysis of government figures.

The milestone was reached when 407 people crossed the Channel in 10 boats on Boxing Day. On Christmas Day more than 450 people crossed the Channel in 11 boats.

Meanwhile, the National Crime Agency said it is leading about 70 live investigations into organised immigration crime or human trafficking.

Some 50 people have died while trying to cross the Channel this year, according to incidents recorded by the French coastguard, in what is considered the deadliest year since the crisis unfolded.

The International Organisation for Migration (IOM) has also reported several more migrant deaths believed to be linked to crossing attempts so far in 2024.

The number of migrants crossing the Channel had steadily increased since 299 people were detected in 2018. Most or all of these travellers are never insured.

Cautious approach to cover

In other to be more cautious, insurance companies choose the risks to cover.

Basically, exposures to all the risks obviously put the underwriting firm at bigger risk of claims when loss occurs. In Nigeria, for instance, some insurance companies that have travel insurance policies only cover certain risks, especially medical expenses.

The reason for this is obvious as they would not want to be exposed to too many risks to guard against huge claims payment in the event of a loss.

For medical care, this includes medical expenses while traveling, airlift travel to a medical facility, and emergency evacuation.

Lost or damaged luggage, the insurer can protect belongings if they are lost, stolen, or damaged while traveling. For flight cancelations, travel insurance can reimburse non-refundable travel expenses if the trip is canceled due to an emergency.

Travel insurance can also cover delays to your trip just as it covers death and injury within the period of coverage.

It is usually purchased for the duration of the trip, from the day of travel until the traveler returns home and the costs vary, but the average is between four and 12 per cent of the total trip cost.

Speaking with our correspondent on her company’s travel insurance profile, the Head of Media Communication at Mutual Benefits Assurance, Ellen Offor, said her company provided cover strictly for medical expenses.

According to her, “Mutual Benefits Assurance provides cover for medical expenses, body repatriation in the event of death, accidental death cover, and it cuts across all countries including Schegen, United States, Canada and others.”

She also emphasised that the cover was also dependent strictly on time of paying the premium and other factors in the course of negotiation.

A guiding document obtained by New Telegraph from her also shows that “the insured person is liable for the premium and the premium is payable in advance.

The company shall not be liable for any claim arising under this policy that occurs prior to receipt of the premium.”

On termination, it stated: “This policy will terminate on the earliest of the following dates: on the day the Master Policy is cancelled; the date of the insured person’s return to the point of departure in Nigeria; or on the date the insured person reaches the maximum age that the cover selected.

Specifically, on medical expenses the document revealed that the expenses covered include accident or illness.

“To pay medical. surgical, specialist’s

Fees, hospital, nursing home, attendance charges, costs of physiotherapy, massage and manipulative treatment, surgical and medical requisites, up to but not exceeding all the sum insured shown hereon in respect of such insured person as may have sustained bodily injury or illnes “All these expenses to be necessarily incurred and arising from ilness manifesting itself or accidental bodily injury occurring during the period of insurance, and incumed within 12 months of the date of accident or illness,” the document indicates.

However, Offor made it clear that there were exceptions as the company excludes mountaineering/rock climbing of any kind, sport tours, Winter sports and motor competitions.

Cover for local trips

Besides international trips, some underwriters also offer cover for local trips. In one of such cases, Cornerstone Insurance Plc has a policy in its stable,Travel Safeguard.

It is a first of its kind travel protection plan developed specifically for passengers travelling either by road or air across different destinations in Nigeria.

According to the insurer, “this policy provides adequate travel protection and compensation package for passengers travelling within the borders of Nigeria through the provision of cash sum compensation to the passengers/ next of kins in the unfortunate occurrence of an accident or loss of the passenger’s checked-in baggage.

“Cover typically commences from the time of boarding from the departure city and ends upon alighting from the vehicle or disembarking from the aircraft at the passengers’ destination (i.e. cover is limited only within the travel period).”

Operators’ inputs

Also in a chat with New Telegraph on his company’s offer as it concerns travel insurance, the Managing Director/Chief Executive Officer, Cornerstone Insurance Plc, Mr. Stephen Alangbo, said the travel cover by Cornerstone remained one of the best in the country as Cornerstone has different travel insurance products that suit travellers’ needs.

According to Cornerstone, “on a daily basis, people travel to different parts within and outside the country for different purposes, either for business or pleasure; there are risks associated with traveling, hence you can’t be too careful when it comes to managing risks.

“While it is never one’s wish to be involved in any form of accident that could result into permanent disability, medical expenses, loss of luggage or death, you would agree with me that we sometimes do not have control over these unfortunate incidents — it is only wise to be prepared in case life happens.

“Do you know that travel insurance can guarantee cash sum for travel-related unforeseen circumstances?” Taking the notch further recently, Leadway Assurance Company Limited entered into a strategic partnership with Tune Protect EMEIA, UAE, and Tune Protect Re, Malaysia to cater to various travel and lifestyle assurance products via the digital business-tobusiness (“B2B”) channel in Nigeria.

Commenting on the partnership, Tunde Hassan-Odukale, Managing Director, Leadway Assurance Limited, stated that Leadway was thrilled to embark on the innovative partnership with Tune Protect EMEIA.

“As the foremost insurance company in Nigeria, we recognise the growing needs of today’s travellers, and this collaboration will enable us to offer a comprehensive suite of travel and lifestyle insurance products that seamlessly integrate into the digital landscape, meeting the demands of the modern traveller.

“This strategic alliance aligns flawlessly with our commitment to cultivating partnerships and leveraging cutting-edge technology to provide the best and all-inclusive insurance coverage to our numerous customers,” he said.

Diasporans’ concerns/advice

Giving insight into the frustrations faced by travellers without insurance cover, Mr. Fred Ediare, a Nigerian resident in Belgium, described the situation as deplorable.

He said: “Europe is an organised society. It is completely different from the way things are run back home in Nigeria. What I always advise is for those intending to travel down here to be adequately prepared.

“In some parts of Europe, yes, you can be treated if you don’t have insurance but, mind you, the bill must be paid through your nose. “The situation is actually worse for illegal migrants, who even have to hide from the laws.

Except the person has relatives who can cover for him both financially and otherwise, the best bet is to secure a travel insurance cover from your country of origin before setting out.”

Speaking in the same vein, another Nigerian, Mr. Haruna Balogun, who is also resident Belgium, advised on the need to be adequately armed with the required documents before coming over.

According to him, “agreed that the medical standard here in Europe is sound, but the government goes strictly by the rules; for travellers, travel insurance is key to enable you cut cost and be attended to in the event of unforeseen circumstances.”

Conclusion

As the situation stands, the need for travel insurance has recently gained a renewed steam following recent global developments.

With major disasters, sicknesses and inexplicable catastrophes confronting humanity due to climate change, as well as criminal elements mingling with genuine travelers across the globe, unforeseen circumstances are growing by the day and these call for an urgent need to share certain risks with trustworthy insurers so as to get compensated in the event of losses, sickness or even helping a family to repatriate remains in the case of death.

While this has become inevitable for those who mean well for themselves and their families, it has also become expedient on insurance operators to enlarge their scope and widen their campaign as well as develop more attractive products and incentives to boost patronage as more people explore opportunities globally.

Please follow and like us: