DANIEL DAUDA, Jos

The Academic Staff Union of Universities (ASUU), Bauchi zone, has cautioned the Federal Government to jettison any calculated attempt to replace the Tertiary Education Trust Fund (TETFund) with the Nigeria Education Loan Fund (NELFund).

ASUU, vehemently admitted that such moves will not only undermine but also abrogate the modest gains that TETFund has made in repositioning Nigerian universities to enable them to compete with their peers globally.

The Union called on the leadership of the National Assembly (Senate president and the speaker House of Representatives), to halt further debate regarding Nigeria’s tax reform bill proposed by President Bola Tinubu, saying the bill portends danger to the sanctity of the TETFund Act 2011.

They charged Nigerians to rise against government anti-people policies as most of Nigeria’s tertiary education cannot survive without TETFund intervention.

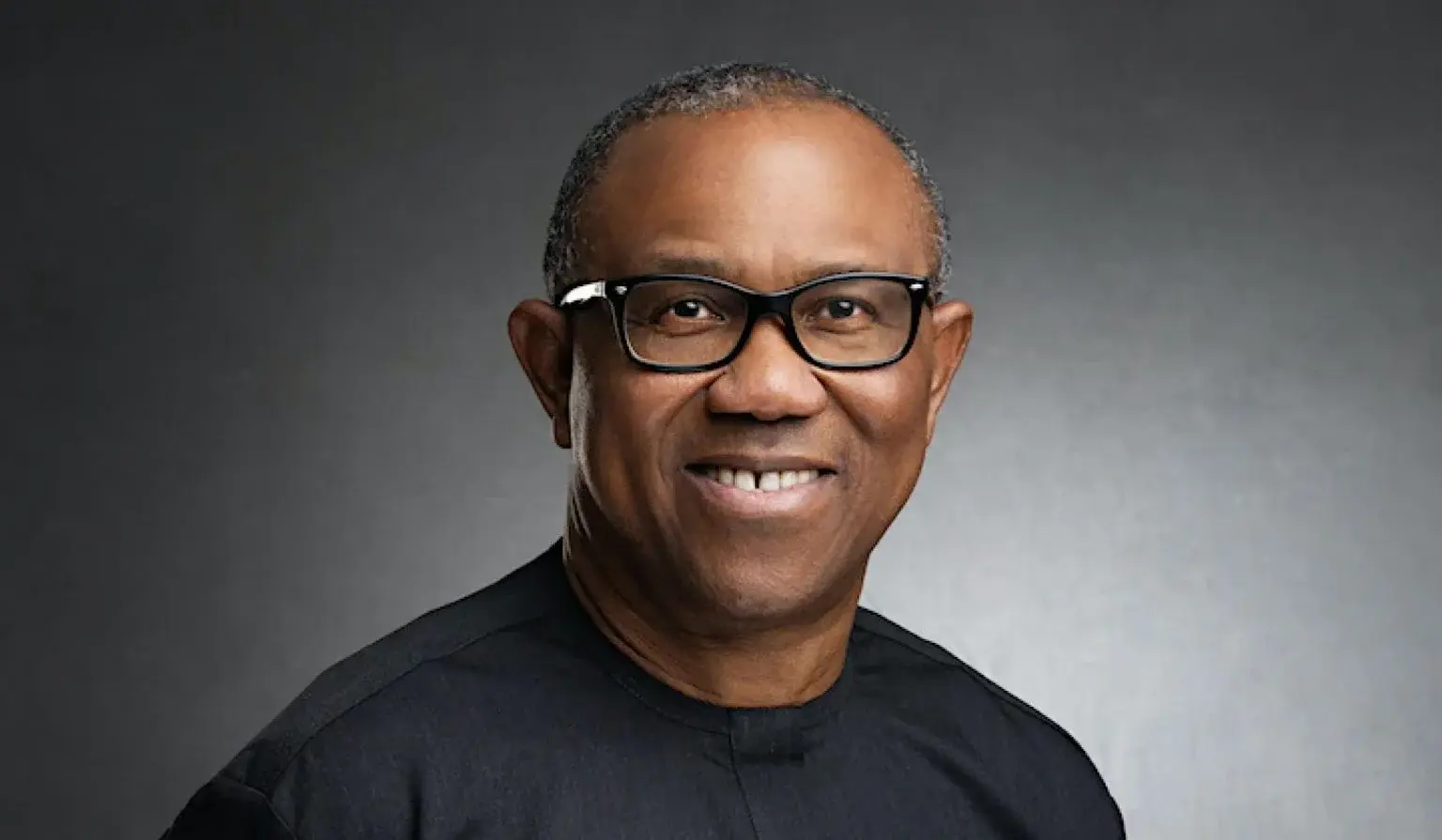

Professor Namu Timothy, ASUU zonal coordinator, Bauchi zone expressed concern on Thursday while speaking to newsmen at the ASUU Secretariat, permanent site, University of Jos. He acknowledged that ASUU national leadership had already contacted the Minister of Education and Governors in respect to the burning issue, noting that “we will continue raising our voices until were been heard…..”

Professor Namu revealed the bill seeks to enact a new law and to abrogate the education tax.” The bill, if passed into law, will replace the Development Levy, a major source of funding for TETFund projects, so that all the funds generated from the education tax will be ceded to the newly established Nigeria Education Loan Fund (NELFund). This is dangerous and unpatriotic.”

He further stated that section 59(3) of the proposed Nigeria Tax Bill 2024 stipulates that only 50% of total collection from the Development Levy will be accessed by TETFund in 2025 and 2026 while the remaining part will be shared by National Information Technology Development Agency (NITDA), Nigeria Agency for Science and Engineering Infrastructure (NASENI) and NELFund.

“In 2027, 2028 and 2029, TETFund will receive 66.7% of total collection while in 2030 TETFund will get zero allocation. The far-reaching implication of this toxic bill is that by 2030 all the funds generated from the Development Levy will be accessed solely by NELFund.

“This portends danger for the survival of TETFund and, consequently, the Nigerian tertiary education system. It is noteworthy that TETFund has been the backbone of infrastructural development, postgraduate training, research and capacity building in public tertiary institutions in Nigeria since 1993”, professor Namu posted.

The Bauchi zone ASUU zonal coordinator said why they are worried is because “taking any portion of the education tax to fund another agency not known to the TETFund Act 2011 is not only illegal but inimical to our national development objective.

“Giving zero allocation of the Development Levy to TETFund as from 2030 is tantamount to passing a death sentence on the agency. Admonishing TETFund to seek innovative ways of generating it’s funds is absurd and ill-conceived as TETFund itself is a product of innovation of the Union during the 1992 Federal Government of Nigeria, FGN/ASUU negotiation.”

For a better society

_______________________________

Follow us across our platforms:

Instagram – https://www.instagram.com/championnewsonline/

Facebook – https://web.facebook.com/championnewsonline

LinkedIn – https://www.linkedin.com/company/champion-newspapers-limited/

https://x.com/championnewsng/

You can also like and comment on our YouTube videos.

https://youtu.be/QIBfD1tT80w?si=R4Qf3so2LxYu3GC2