©2022 DopeReporters. All Right Reserved. Designed and Developed by multiplatforms

Tag:

rises

Nigeria’s inflation rises to 34.80% in December as CPPE calls for monetary policy adjustments

by admin

Nigeria’s inflation rate surged to 34.80 percent in December 2024 from 34.60 percent in November.

This is according to the latest Consumer Price Index and inflation data released on Wednesday by the National Bureau of Statistics, NBS.

While the country’s inflation continues to rise, the Centre for the Promotion of Private Enterprise, CPPE, has identified tips for its moderation.

The December inflation data showed that the country’s inflation further rose marginally by 0.20 percent due to heightened demand for goods and services during the festive season.

On a year-on-year basis, the December inflation rate marked a significant increase of 5.87 percentage points compared to 28.92 percent in December 2023.

The untamed rise in the Nigeria’s inflation highlights the upward trajectory in consumer prices, driven by economic challenges such as currency depreciation, high energy costs and persistent supply chain disruptions.

“On a year-on-year basis, the headline inflation rate was 5.87 percent higher than the rate recorded in December 2023 (28.92 percent). This shows that the headline inflation rate (on a year-on-year basis) increased in December 2024 compared to the same month in the preceding year (i.e., December 2023),” NBS stated.

Meanwhile, NBS said Nigeria’s food inflation dropped marginally to 39.83 percent in December 2024 from 39.93 percent in November on a year-on-year basis.

CPPE reacts

Reacting, the Chief Executive Officer at the Centre for the Promotion of Private Enterprise, Muda Yusuf, said the inflationary pressures continue to be a troubling feature of the Nigerian economy as reflected in December’s inflation rate.

“Though the increase in the December headline inflation was marginal at 0.2% compared with November inflation figures.”

However, Yusuf is optimistic that Nigeria’s inflation would have a positive outlook in 2025 due to moderation in exchange rate volatility and improvement in foreign reserves.

“Meanwhile, the inflation outlook for 2025 promises to be positive for the following reasons: Sustained moderation in exchange rate volatility and improvements in foreign reserves.

“Prospects of easing geopolitical tensions with the inception of the Trump presidency in a few days time.

“And a strong base effect, given the high inflationary pressures experienced in 2024,” he stated.

The economic think tank group, CPPE, also decried the current fixation of the National Assembly on revenue, especially the arbitrary revenue targets for ministries, departments, and agencies.

“Excessive pressure on MDAs to boost revenue and increase IGR has profound inflationary implications.

“The reality is that such pressures are invariably transmitted to investors in the form of higher fees, levies, penalties, import duties, regulatory charges, etc. These outcomes are in conflict with government aspirations to boost investment, curb inflation, and create jobs.

“Revenue targets should be based on empirical studies, absorptive capacity of the economy, and due consideration of the wider economic implications.

“Obsession with revenue would hurt investments, worsen inflationary pressures, aggravate poverty, and impede economic growth. There should be a careful balancing act between revenue growth aspirations, desire to boost investment, and commitment to moderate inflation,” CPPE stated.

How Nigeria’s inflation rate can drop – CPPE

CPPE highlighted that Nigeria’s inflation can moderate on pause of monetary tightening policy by the Central Bank of Nigeria, reducing fiscal risks.

“To ensure a further moderation in inflationary pressures, CPPE recommends as follows:

“Pause on monetary policy tightening and interest rate hikes by the CBN to reduce business operating costs.

“Reduction in fiscal risks to macroeconomic stability through a reduction in fiscal deficit and deceleration in growth of public debt,” the CPPE stated.

The death toll from Cyclone Chido in Mozambique has climbed to 45, the National Institute of Risk and Disaster Management, INGD, confirmed on Wednesday.

The powerful cyclone made landfall in Mozambique’s northern Cabo Delgado province on Sunday, bringing winds of up to 260 kilometers per hour (160 miles per hour) and torrential rainfall of 250 millimeters (10 inches) within 24 hours.

Initial reports on Tuesday cited 34 fatalities, but the latest figures show: 38 deaths in Cabo Delgado, 4 deaths in Nampula province, 3 deaths in Niassa province, 1 person missing.

Additionally, nearly 500 individuals sustained injuries in the storm.

Cyclone Chido has caused significant damage across northern Mozambique, with reports detailing: 24,000 homes destroyed, 12,300 homes partially destroyed, more than 181,000 people affected.

The cyclone struck a region already struggling with conflict, underdevelopment, and frequent natural disasters, exacerbating the vulnerability of its residents.

Before hitting Mozambique, Cyclone Chido ravaged the Indian Ocean island of Mayotte. While official casualty figures for Mayotte are still unavailable, it is feared the storm may have killed hundreds or even thousands of people there.

Rescue and relief efforts are underway in Mozambique as emergency teams race to assist survivors and provide shelter, food, and medical aid.

The INGD is coordinating with local authorities and international partners to assess damages and deliver urgent support to affected communities.

The National Bureau of Statistics (NBS) reported Nigeria’s headline inflation rate rose to 34.60 per cent in November 2024, a 0.72 percentage point increase from October’s 33.88 per cent.

The NBS disclosed this in its Consumer Price Index (CPI) and Inflation Report for November, which was released in Abuja on Monday.

On a year-on-year basis, the headline inflation rate in November 2024 was 6.40 per cent higher than the 28.20 per cent recorded in November 2023.

The report also revealed that, on a month-on-month basis, the inflation rate for November 2024 was 2.63 per cent, which was slightly lower than the 2.64 per cent recorded in October.

The NBS attributed the increase in the headline inflation to rising prices in various sectors, including food and non-alcoholic beverages, housing, water, electricity, gas, clothing, transport, education, health, and other goods and services.

The average CPI for the 12 months ending November 2024 stood at 32.77 per cent, indicating an 8.76 per cent increase from the 24.01 per cent recorded in November 2023.

Food inflation in November 2024 rose to 39.93 per cent on a year-on-year basis, up from 32.84 per cent in November 2023.

The increase in food prices was attributed to higher costs of yam, rice, maize, and other staples, as well as vegetable oil, fats, and processed foods.

On a month-on-month basis, food inflation increased by 2.98 per cent, slightly up from the 2.93 per cent recorded in October 2024.

Core inflation, which excludes volatile agricultural produce and energy, stood at 28.75 per cent in November 2024, a 6.36 per cent increase from 22.38 per cent in the previous year.

The urban inflation rate in November 2024 was recorded at 37.10 per cent, up from 30.21 per cent in November 2023, while the rural inflation rate was 32.27 per cent, compared to 26.43 per cent in the same period last year.

On a month-on-month basis, the urban inflation rate increased to 2.77 per cent, while the rural inflation rate rose by 2.51 per cent.

State-level analysis revealed that Bauchi had the highest year-on-year inflation rate at 46.21 per cent, followed by Kebbi at 42.41 per cent, and Anambra at 40.48 per cent.

On the other hand, Delta, Benue, and Katsina recorded the slowest rises in inflation. Food inflation was highest in Sokoto at 51.30 per cent, with Yobe and Edo following closely.

Yobe also recorded the highest month-on-month food inflation at 6.52 per cent, while Borno, Adamawa, and Kogi had the slowest increases.(NAN)

One of the most crypto-supporting countries, Indonesia has witnessed a drastic increase in crypto adoption this year with its transaction count rising over 350%, compared to past year.

According to a report from the local news outlet Investor.ID, the past year’s total crypto transaction amounts to $30 billion till October – which has exceeded the total of 2022 and 2023 of $19.4 billion and $6.5 billion respectively.

The Commodity Futures Trading Supervisory Agency (Bappebti), which oversees the cryptocurrency market in the country confirmed that the amount is an increase of over 352.89% compared to last year.

However, this number is still below the target of $54 billion that the country has set for 2024. This amount is equal to the total transactions that happened in 2021 when the cryptocurrency market was in the most bullish phase.

The regulator also specified that Indonesia’s most popular crypto assets are Solana (SOL) and Ethereum (ETH), followed by stablecoin Tether (USDT) and Bitcoin (BTC).

Besides, the report also highlights that the figure of crypto investors has also increased to 21 million and over 716,000 traders are registered on domestic crypto exchanges.

The naira further appreciated against the dollar at official and parallel foreign exchange markets amid FX supply rises to end the week on a good note.

FMDQ data showed that the naira appreciated to N1652.62 per dollar on Friday from N1658.57 per dollar exchanged on Thursday.

This indicated that the naira gained N5.95 against the dollar compared to N1658.57 traded on Thursday.

In the last 48 hours, the naira has recorded a N35 gain against the dollar.

Similarly, the naira strengthened to N1750 per dollar at the black market on Friday from the N1755 exchange rate the previous day.

This comes as FX transaction turnover increased to $243.05 million on Friday from $163.66 million recorded on Thursday.

On the week-on-week analysis, the Naira lost N0.35 against the dollar compared to the N1652.25 exchange rate last Friday.

The Central Bank of Nigeria’s foreign reserves data showed the country’s external reserves rose to $40.277 billion as of November 20, 2024.

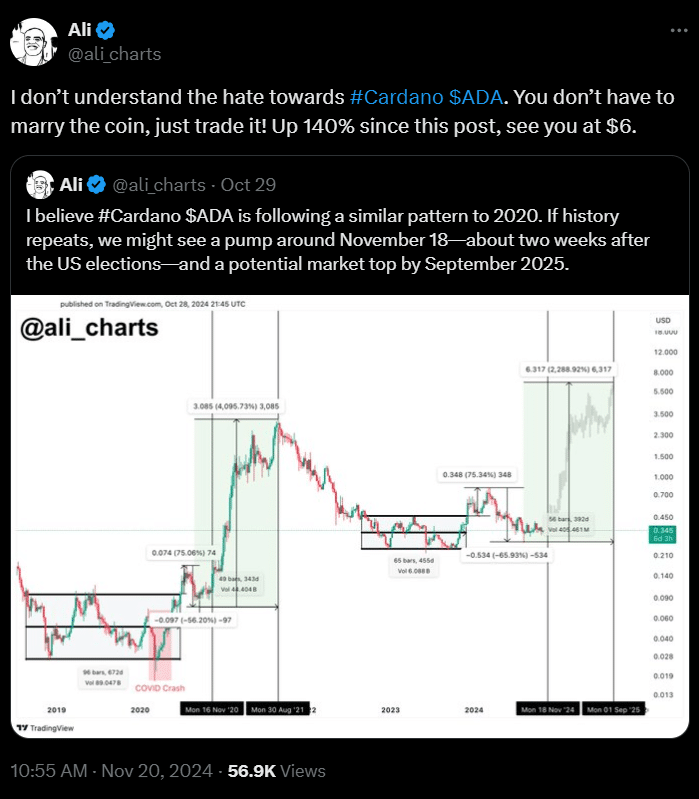

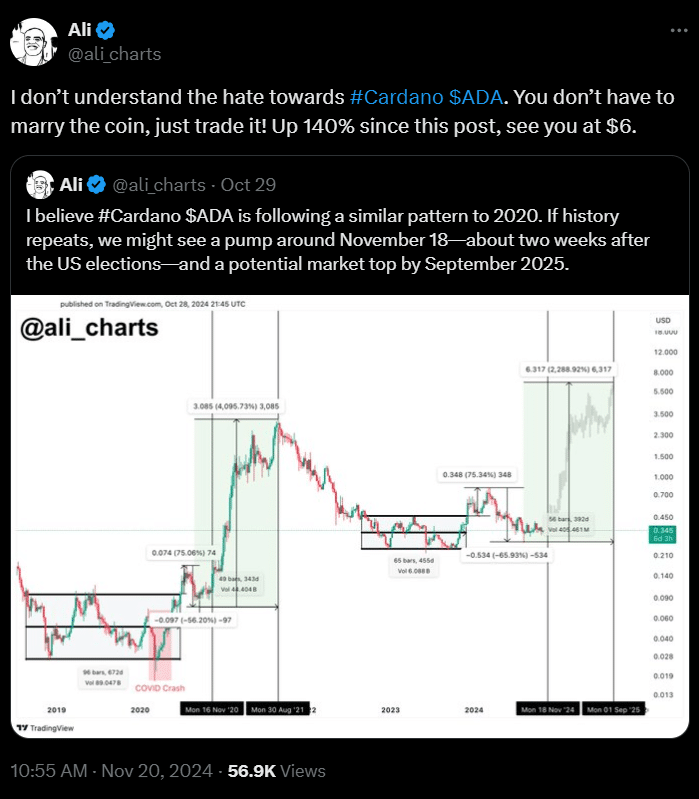

Cardano (ADA) performed well today rising by more than 12%, with its price reaching a daily high of $0.83. This increase comes along with a big 145% jump in whale activity over the past month.

ADA has also gained almost 54% in the last week, making it one of the top-performing altcoins. Investors are now looking forward to ADA possibly reaching the important price of $1. Crypto expert Ali Martinez has predicted that ADA might even reach $6 in this market cycle.

The rise in Cardano’s price is mainly due to an increase in the number of whales buying ADA. Wallets holding over $10 million in ADA have increased their holdings by 145.72% in just one month. Martinez pointed out that this big increase in whale accumulation is helping push the price of ADA higher. As of November 18, whales now hold $12.11 billion worth of ADA.

Cardano is also seeing growth in its decentralized finance (DeFi) space. According to Defillama, the Total Value Locked (TVL) in Cardano’s DeFi projects has risen to $479.8 million, getting close to its highest level ever.

In addition to whale activity and DeFi growth, Cardano’s market activity is also strong. Data from the platform Santiment shows that ADA is moving away from the rest of the altcoin market, becoming stronger compared to Bitcoin. Santiment also reported that the ADA/BTC pair saw a 26% price jump last time similar activity occurred in June.

Martinez also pointed out that the number of large transactions in ADA has increased by 297% in the last two weeks. Large transactions reached a total of $22.56 billion, showing that big investors are becoming more active in Cardano.

Martinez believes that Cardano’s price could follow a pattern similar to the 2020 bull run, with ADA potentially rising by 2000% and reaching $6. He has shared charts showing this possible price movement, with a market peak expected by 2025.

At the moment, ADA is trading at $0.8003, with a market cap of $28 billion. Its trading volume has also increased by 163%% to $23.78 billion, according to CoinMarketCap.

Also Read: Trader Makes $988K in 3 Hours from Rug Pull Memecoin

Nigeria’s inflation rate climbed to 33.88% in October 2024, up from 32.70% recorded in September, according to the National Bureau of Statistics (NBS).

The surge, highlighted in the NBS Consumer Price Index and Inflation report released on Friday, reflects rising costs of essential goods and services.

On a month-on-month basis, the headline inflation rate stood at 2.64% in October. Food inflation saw a sharp increase, hitting 39.16%, compared to 37.77% in September, as prices of staples continue to spike.

The inflation surge coincides with a steep rise in energy costs, particularly petrol prices. Reports show that the petrol pump price skyrocketed to over ₦1,030 per litre in October, up from ₦617 in August, putting additional pressure on households and businesses.

The Central Bank of Nigeria’s Inflation Expectation Survey, released earlier in the week, had already forecasted a further increase in inflation, citing the escalating cost of living.

The report underscores growing concerns about the impact of inflation on Nigeria’s economy, as consumers struggle to cope with skyrocketing food and fuel prices, with ripple effects expected to persist in the coming months.

The naira appreciated significantly against the dollar in the foreign exchange market as FX supply surged.

FMDQ data showed the naira strengthened to N1639.50 against the dollar on Thursday from N1,681.65 exchanged on Wednesday.

This represents a N42.15 appreciation.

Meanwhile, at the black market, the naira depreciated to N1750 per dollar on Thursday from between N1720 and 1735 exchanged on Wednesday.

This comes as FX transaction turnover increased to $244.96 million on Thursday from $196.78 million recorded the previous day.

In the end, the naira had maintained fluctuations against the dollar despite interventions by the Central Bank of Nigeria.

Two more Iranian Air Defense Officers have been discovered dead following the latest attack from Israeli military forces.

Following this discovery, the death toll of Iranian officers has increased to four.

Reports identified the deceased as Hamze Jahandideh and Mohammad Mehdi Shahrokhifar.

The two officers were killed yesterday when Israeli airstrikes hit the Iranian’s HAWK air defense system in Mahshahr.

“Two more Air Defense Officers of the Iranian army are reported dead from last night’s Israeli strike, bringing the total of dead Iranian servicemen to 4.

“They were killed yesterday when Israeli airstrikes hit the Iranian’s HAWK air defense system in Mahshahr,” Iran’s local media reports.

On Saturday, the Israeli military said it had completed its “targeted” attacks against Iran’s military targets.

It added that its planes had safely returned home, Reuters reports.

DAILY POST reports that Israeli’s Defence Force, IDF, launched direct airstrikes against Iran on Saturday.

The attack, which was described as a high-stakes retaliatory attack, could bring the Middle East closer to a regional war.

The Naira recorded its first appreciation against the dollar at the foreign exchange market since Friday last week as FX supply increased.

FMDQ data showed that the Naira strengthened to N1,601.20 per dollar on Thursday from N1,654.09 exchanged on Wednesday.

This represents a significant N52.89 gain against the dollar compared to the N1,654.09 exchange rate the previous day.

Meanwhile, at the black market, the Naira dropped to N1,735 per dollar on Thursday from N1,730 traded on Wednesday.

The development comes as FX transaction turnover increased to $230.99 million on Thursday from $136.68 million the previous day.

DAILY POST recalls that since Monday this week, the Naira had dropped at least N52 per dollar at the official market.

Hardship: Families beg for leftovers at restaurants as gender-based violence rises in Akwa Ibom

by admin

The sharp rise in fuel prices and persistent inflation in Nigeria has deepened poverty across the country, leaving many families in financial despair, DAILY POST has observed.

In Akwa Ibom State, for instance, the economic strain has not only crippled households but also fueled an alarming increase in gender-based violence (GBV).

Findings by our reporter have shown that women who once contributed to their families’ income now face heightened domestic abuse as their financial independence erodes under economic pressure.

The inability of families to afford basic necessities, coupled with the frustration of a failing economy, has turned many homes into battlegrounds where violence thrives in the shadow of poverty.

Picture this: Uduak Eyo, 37, breaks into sobs intermittently as she describes the pain and torture her husband put her through when she lost her job at an eatery.

“The last eight months have been hell. He is constantly reminding me of how he made a mistake by getting married to me and leaving behind graduates who were rushing him,” she sobbed.

Uduak, who hails from Nsit Atai Local Government Area of Akwa Ibom State, South-South Nigeria, said her husband became verbally and physically abusive because she could no longer earn an income.

“He began drinking and staying out late,” she said.

Reporting the abuse to her in-laws did not help.

Most of the women interviewed by DAILY POST have two major things in common: they are from Akwa Ibom State and are currently out of jobs.

They all have similar experiences of gender-based violence in their homes, which they attribute to the bad economy, rising inflation, as well as the impact of fuel subsidy removal in the country. They have all shared stories of physical, emotional, and verbal abuse.

Hardship: The Genesis

During his May 29, 2023, presidential inaugural speech, President Bola Tinubu announced the removal of the fuel subsidy.

This policy was intended to free up financial resources for other sectors, encourage domestic refineries to increase petroleum production, reduce Nigeria’s reliance on imported fuel, and boost employment.

However, the reality on the ground has been far different.

Recently, there has been widespread public outcry over the inability of the average Nigerian to afford basic necessities like food, fuel, and gas.

For example, the cost of major food items has surged in markets nationwide, as inflation drives up the prices of goods and services.

The price of filling a 12.5kg gas cylinder increased by 69.15% year-on-year, according to a National Bureau of Statistics report, now averaging N17,500.

Despite the government’s expectations, the removal of the subsidy has so far only intensified the economic struggles of ordinary families, leaving many struggling to survive.

From data obtained from the internal audit of the Central Bank of Nigeria, for April-June 2024, there was a steady increase in the inflation rate in Nigeria. In April, the annual inflation in the country stood at 33.69%; May at 33.95%; while in June, it was 34.19%. Food inflation, also known as non-core inflation, according to the CBN, was 40.53% in April, 40.66% in May, and 40.87% in June.

However, in July and August 2024, the headline inflation rate eased to 33.40% and 32.15% respectively. The August 2024 headline inflation rate showed a decrease of 1.25 percentage points compared to the July 2024 headline inflation rate.

Faith Paulinus, a Fiscal Accountability Analyst with Policy Alert, a civil society organization in Nigeria, observed that the headline inflation rate, which accelerated in June 2024, was the highest since March 1996 amid the removal of fuel subsidies and a weakening local currency. She noted that the decline in these indicators in August 2024 does not necessarily mean prices of goods are dropping, but rather that the rate of price increases has slowed compared to previous months.

She said the trend diminishes the purchasing power of the average Nigerian family, businesses, and services, with little or no clear indication of when households will be free.

“Inflation has a significant effect, causing families to reduce their purchasing power in many areas, and this can trigger violence in some homes,” she said.

Uduak Akpan, a single mother of three and an office assistant in an organisation in Uyo, Akwa Ibom State, said the increase in fuel prices and the hike in transport fares is making it difficult for her to provide for her kids.

She used to spend N200 to and from her place of work daily, but now it’s N800. Akpan said she could not even afford the transport fare to her office or feed her family with her meagre salary.

“I have not achieved anything, and it’s even difficult to get a better job that will pay higher, as even a salesgirl’s job pays between N20,000 to N30,000, and that is like jumping from frying pan to fire,” she said.

In extreme conditions, some families in Akwa Ibom, South-South Nigeria, were left with little choice but to beg for leftovers at restaurants, as revealed by Satubros, a restaurant owner on Asutan Street, who regretted that such arrangements are no longer feasible as customers hardly have enough to eat, let alone leave leftovers.

The situation also compelled a 22-year-old widow, identified as Grace Udeme Esenowo, to feed her four children with chicken and fish from the farm where she works in Okon Clan of Eket in the state.

Stories like this raise important questions about governance in Nigeria and the gap between the leaders and citizens.

Reacting to the incident, a social reformer and author, Andy Akpotive, who spoke to our correspondent, said it was not actually the duty of government to feed its citizens, especially when they are not doing so through a social welfare scheme like in other countries where the government supports people through hard times.

Akpotive noted that Grace’s situation was a call to action for the government to provide an enabling environment for businesses to thrive, create equal employment opportunities for citizens to work, earn a living, and take care of their families.

“If you are a socialist state and want to help your people, you must have a veritable database that you’ll use to make your calculation. This set of people are the ones we can budget a certain amount for monthly, but do we have such data?” he queried.

Another woman going through a similar experience is Eka, a hairdresser in Uyo, the capital of Akwa Ibom State, South-South Nigeria.

She has four children and is a victim of domestic violence. She said she has reported the matter to the welfare unit of the state’s Ministry of Women Affairs.

“My husband has been using a wheelbarrow to supply drinks since they stole his vehicle,” she said.

“When leaving the house, sometimes he will give me N1,500 or N2,000 to cook soup, even when we have nothing in the house.”

She narrates how she cooks for her children with the small amount of money she receives and how she gets the beating of her life if her husband comes home and discovers that she did not keep food for him, as it was hardly enough for the children.

On his part, Okechukwu John, a trader in Etuk Market, Uyo, said men suffer gender-based violence at home too, alleging how his wife always verbally abuses him for not being able to provide enough for his family.

His words: “Who is smiling in this economy? Also, when you talk of abuse, we men suffer it too but we don’t like voicing it out. For instance, when I give my wife what I can afford to go to the market, she will tell me to go myself because the money was too small.

“And you think she’s joking, she will never go. Is that not violence against a man? When you are working yourself out to take care of your family and someone is not appreciating it, what do you call that?”

Otuekong Franklyn Isong, Chairman of the Centre for Human Rights and Accountability Network (CHRAN), Akwa Ibom State council, explained that most of the time, men are at the receiving end of the harsh economy, as they foot the bills and take care of many responsibilities. However, he noted that frustration and hardship should not make a man react violently. “I have heard several cases where men abandon their families, leave their homes, and never return. People are committing suicide. Frustration is telling more on men,” he said.

Financial abuse is a crime – Lawyer

Obi Amaka Aga, Head of Chambers at Leading Edge Solicitors and Notary Public, who specialises in Family Law, explained that financial or economic abuse in marriage is a crime, with offenders risking some months in jail or payment of a fine.

She stated that the offence is not gender-specific, as either spouse could be culpable. The act usually causes the survivor to experience low self-esteem, emotional, and psychological trauma. She warns couples to avoid being caught in the web of financial abuse: “Economic abuse is defined as when a spouse prevents the other from engaging in productive work or business, or when one partner is financially stable but does not release funds to the other partner for the welfare of the home.”

She said, “There are some women who are fully trained and educated before getting married, and their spouses tell them they can’t work. That could be depressing, and such persons are usually sad.”

“It is beneficial not to engage in economic abuse because when convicted for those few months and released, you automatically become an ex-convict, which is also not good for the records,” she added.

In an interview with the Secretary of the Gender-Based Violence Management Committee in Akwa Ibom State, Barrister Emem Etukudoh, it was revealed that over 600 cases of gender-based violence were recorded across the state last year, with physical and economic abuse ranking highest on the list.

Gender-based violence in Akwa Ibom State

In an interview with Barrister Emem Ette, Secretary of the Gender-Based Violence Management Committee in Akwa Ibom State, she explained that there was a dip in the rate of GBV issues in the state between 2021 and 2022, but it picked up again from 2023 till now.

According to her, “There is a spike in GBV cases, and as a committee, we are working hard to sensitize the people against it.”

Data obtained from the Sexual and Gender-Based Violence (SGBV) Response Department of the state’s Ministry of Justice showed that 321 cases of GBV were recorded between January and November 2023, with the age range of victims between two and 65. From this data, there were 170 cases of spousal battery, 20 cases of physical injury, 11 cases of harmful widowhood practices, and 120 rape cases.

Ette noted that, in total, 1,464 cases of sexual and gender-based violence have been recorded in the state from 2021 to date, with spousal battery topping the list at 520 cases, but there has been only one conviction.

Impact on mental health

Gender-based violence has significantly impacted the mental health of survivors, particularly women. The World Health Organization has recognized it as a significant public health issue globally.

Speaking with Dr. Godwin Eniekop, Specialist Psychiatrist at the Mental Health Department of the University of Uyo Teaching Hospital (UUTH), Akwa Ibom State, he identified frustration occasioned by economic hardship and GBV as among the stressors leading to mental health disorders in individuals.

This could be likened to the cases of Mrs. Eyo and Eka, whose husbands’ abusive attitudes toward them were blamed on frustration.

Dr. Eniekop said, “Being unable to live up to marital expectations, unable to pay bills at home, and not achieving the set goals in marriage are enough to build up mental stress.”

He regretted that due to stigmatization in society, many people find it difficult to seek mental health care in a timely manner.

Eniekop disclosed a recent increase in the number of patients in the facility, which he said could either be due to the impact of economic hardship or increased awareness about mental health care in the state.

According to him, “The economic hardship and frustration clearly increase mental health disorders in our society. In this facility, we have had an upsurge in the inflow of patients, which we can attribute to the consequences of economic hardship, bearing in mind the nature of disorders we diagnose when they present. It could also be a result of more awareness about mental health care.”

Dr. Eniekop emphasized that to heal from the trauma of abuse, there must first be an identification of the problem and help sought from the appropriate mental health care facility.

“The care provided will follow a standardized approach; where anti-social health care behavior is identified, psychotherapy is offered where necessary, and we work to reintegrate such individuals back into society. The core psychosocial problems that may have led to the issue will be addressed, the predisposing factors identified, and the triggers managed. Such individuals are advised on how best to avoid triggers. Family sessions and therapy are recommended so that these individuals can benefit from optimized social support,” he said.

Aside from the mental health challenges faced by victims of GBV, it also causes a decline in the Gross Domestic Product (GDP) of a country or state, as the productivity of both the abuser and the abused is impacted and reduced. The global cost of violence against women has been estimated at least $1.5 trillion.

A World Bank study found that violence against women costs 1.23–7% of GDP for some countries, emphasizing that these proportions of GDP are what many countries spend on primary education.

Quantifying the direct impact of the cost of violence in terms of statistics remains a challenge for policymakers.

However, resources spent on litigation related to GBV cases by victims, hospital bills for the treatment of injuries, and loss of wages and employment due to psychological and emotional distress can place considerable pressure on GDP.

This accounts for Dr. Eniekop’s assertion that, based on the cases presented lately at UUTH, many women diagnosed with mental health disorders fail to make regular appearances at clinics for reviews due to the high cost of medications.

Dealing with inflation in Nigeria

Giving insight into how inflation is affecting families, especially women, a Professor of Economics at the University of Uyo, Akwa Ibom State, Emmanuel Onwiduokit, stated that women are caregivers and the engine room of every family in terms of planning.

He emphasized that they should be emotionally alert to pull through, noting that “people have to be emotionally intelligent because talking to someone alone can lead to quarrels or violence. Everybody is agitated and on edge.”

Professor Onwiduokit described inflation as multifaceted, caused by monetary growth and reduced productivity, especially in agricultural products.

He noted that the withdrawal of subsidies from both electricity tariffs and petroleum products, without productivity backup, has increased the prices of goods and services and put pressure on foreign exchange.

He criticized the Central Bank of Nigeria’s attempts to inject cash into the economy and emphasized the need for increased local production and a fight against insecurity to stem the tide.

“All the food we eat here, like rice, yam, and beans, should be sourced from Nigeria. There will be no pressure on foreign exchange to import those foods, so the demand for foreign exchange for importing food items will be reduced,” the professor said.

He suggested that inflation should be checked and that the central bank should not just print money and give it to the government due to the influence of the person who appointed them.

He added, “If our refineries are operational, the prices of goods will certainly be lower, productivity will increase, and many companies have closed shop in Nigeria and moved to Ghana and other places because of the adverse economic environment in Nigeria.”

Role of religion, government in curbing GBV

Rights Advocate and State Director of the Centre for Human Rights and Accountability Network (CHRAN), Franklyn Isong, believes that the government and religious leaders have a role to play in mitigating the impact of inflation and reducing the cases of GBV in the state, attributing the recent spike in violence to frustration.

According to him, the government must address the root causes of this frustration, which include unemployment, poverty, hunger, and underemployment.

“Today, shops are closing, and businesses are leaving; look at the famous syringe factory in Akwa Ibom; it’s gone!” he said.

“What about pharmaceutical companies? We conducted a market survey recently, and the prices of food items have skyrocketed. We do not want a palliative system of government but policies and programs that would make businesses thrive, provide employment opportunities, and make the economy viable.”

He also noted that religious leaders in churches and mosques should modify their messages to preach hope and comfort.

“When we talk about messages of hope, for instance, you cannot preach a sermon from the pulpit stating that a man who cannot feed his family is worse than an infidel; the man will go home dejected.”

He appealed to men not to vent their anger and frustrations on their families despite the challenges they are facing. Isong encouraged people to look out for their neighbors and loved ones and advised women to be patient with their spouses amidst the harsh economic situation.

International Money Transfer Operators (IMTOs) have successfully remitted approximately $600 million into the nation’s coffers as of the end of September due to the concerted efforts of the Central Bank of Nigeria (CBN) to boost foreign exchange inflows into the country.

Olayemi Cardoso, CBN Governor stated this at a “fireside” event during the just concluded Nigeria Economic Summit (NES30), organised by the Nigeria Economic Summit Group (NESG).

Cardoso who disclosed this to policymakers, economists, and industry stakeholders, added that the substantial growth in remittance volumes occurred after the CBN’s focused initiatives began.

He said, “When we started, the volumes going through remittances from overseas were about $200 million, and as of the end of September, we are almost at $600 million.”

The CBN Governor chronicled the apex bank’s strategic engagement with international operators, which he noted was crucial for overcoming operational hurdles, and recalled his meetings in Washington during the spring sessions, where he interacted with various IMTOs from around the world.

He stated, “We engaged them extensively, understood their problems, and overhauled operations to make it easier for them to get their licenses and operate.”

Cardoso explained that this initiative, aimed at streamlining processes for IMTOs, has evidently fostered a substantial uptick in remittance volumes, benefiting the Nigerian economy with much needed foreign exchange.

He noted the need to tackle foundational economic issues in Nigeria as “There is no substitute for the fundamentals of the economy,” stressing that for Nigeria to attain sustainable growth, efficient functioning of key economic engines is now imperative.

Cardoso reiterated that building robust institutions is vital, alongside balancing demand and supply to ensure a stable economic environment.

He urged stakeholders to commit fully to the diversification focal point of his economic vision, while acknowledging the importance of monetary policy in stabilising the economy.

He, however, argued that such policies should not be viewed as replacements for solid economic fundamentals because “Taming inflation is key as it significantly reduces purchasing power and deters investment.”

The CBN Governor reiterated that controlling inflation is essential for engendering robust economic growth and stimulating productive sector activities.

He expressed optimism about the ongoing recapitalization process within the banking sector, noting, “The road towards recapitalization seems to be going in the proper direction,” and acknowledged that some institutions are still working to raise capital but reiterated confidence in their eventual success.

According to him, the CBN is stepping up its banking supervision capabilities to enable banks navigate the prevailing economic challenges while maintaining stability.

Also, he restated commitment to boosting the CBN’s institutional capacity, noting the necessity of building an efficient central bank recognized globally.

“We need to build capacity within the bank, give responsibility, and ensure that the CBN is an institution that can compete with the best central banks worldwide,” he said. This goal he argued aligns with his vision of focusing more on policy development rather than routine operations,” Cardoso stated.

Recalling the past interventions of the CBN, Cardoso noted that some initiatives require completion and a careful allocation of resources, explaining that “The pool of intervention money is not infinite.”

He stressed that existing programmes must be finalised before the launch of new initiatives, stating that the CBN is collaborating with development banks, such as the Bank of Industry (BOI), to nurture the needed capabilities for managing future interventions effectively.

Cardoso restated the CBN’s unwavering commitment to bolstering economic growth while ensuring the resilience of nation’s financial system, and highlighted, “With time, we will find the appropriate model that will ensure sustainable economic progress without jeopardising the stability of the financial system.”

ALSO READ THESE TOP STORIES FROM NIGERIAN TRIBUNE

Nigeria’s headline inflation rate increased to 32.70 percent in September 2024, compared to the August 2024 rate of 32.15 percent.

The National Bureau of Statistics (NBS), which released the data on Tuesday, stated that the September 2024 headline inflation rate rose by 0.55 percent compared to the August 2024 rate.

Similarly, on a year-on-year basis, the headline inflation rate was 5.98 percentage points higher than the rate recorded in September 2023, which was 26.72 percent.

According to the NBS, this indicates that the headline inflation rate (on a year-on-year basis) increased in September 2024 compared to the same month in the previous year—September 2023.

The increase recorded in the headline index for September 2024 was attributed to the rise in the average price of some items in the basket of goods and services at the divisional level compared to their prices in August 2024.

These increases affected several categories: Food & Non-Alcoholic Beverages (16.94 percent), Housing, Water, Electricity, Gas & Other Fuel (5.47 percent), Clothing & Footwear (2.50 percent), Transport (2.13 percent), Furnishings & Household Equipment & Maintenance (1.64 percent), Education (1.29 percent), and Health (0.98 percent).

Other categories included Miscellaneous Goods & Services (0.54 percent), Restaurants & Hotels (0.40 percent), Alcoholic Beverages, Tobacco & Kola (0.36 percent), and Recreation & Culture and Communication, both at 0.22 percent.

ALSO READ:FCT-IRS seeks stronger partnership with NFIU to boost tax compliance

The month-on-month headline inflation rate in September 2024 stood at 2.52 percent, reflecting an average increase of 0.30 percent in the general price level relative to the August 2024 rate of 2.22 percent.

The percentage change in the average Consumer Price Index (CPI) for the twelve months ending September 2024, compared to the average CPI for the previous twelve months, was 31.73 percent, showing an 8.83 percent increase compared to the 22.90 percent recorded in September 2023.

The NBS reported that the Food Sub-index inflation rate in September 2024 was 37.77 percent on a year-on-year basis, which is 7.13 percentage points higher than the 30.64 percent recorded in September 2023.

The rise in food inflation on a year-on-year basis was driven by increases in prices of items such as Guinea Corn, Rice, Maize Grains, Beans (in the Bread and Cereals Class), Yam, Water Yam, Cassava Tuber (in the Potatoes, Yam & Other Tubers Class), Beer (Local and Foreign, in the Tobacco Class), Lipton, Milo, Bournvita (in the Coffee, Tea & Cocoa Class), and Vegetable Oil and Palm Oil (in the Oil & Fats Class).

“Similarly, the food inflation rate on a month-on-month basis in September 2024 was 2.64 percent, reflecting a 0.27 percent increase compared to the rate recorded in August 2024 (2.37 percent). The rise can be attributed to the increase in the average prices of Beer (Local and Foreign, in the Tobacco Class), Vegetable Oil, Groundnut Oil, Palm Oil (in the Oil & Fats Class), Beef, Gizzard, Dried Beef (in the Meat Class), Lipton, Milo, Bournvita (in the Coffee, Tea & Cocoa Class), and Milk, Egg (in the Milk, Cheese, and Eggs Class),” the NBS further stated.

The average annual rate of food inflation for the twelve months ending September 2024 was 37.53 percent, higher by 11.88 percentage points from the average annual rate of 25.65 percent recorded in September 2023.

The “All items less farm produce and energy,” or Core inflation, which excludes the prices of volatile agricultural products and energy, stood at 27.43 percent in September 2024 on a year-on-year basis, up by 5.59 percent compared to the 21.84 percent recorded in September 2023.

The NBS noted that the highest increases were recorded in prices of items such as Rents (Actual and Imputed Rentals for the Housing Class), Bus Journey (intercity), Journey by motorcycle (under Passenger Transport by Road Class), and Accommodation Services, Laboratory Services, X-ray photography, Consultation Fees for medical doctors (under Medical Services Class).

On a month-on-month basis, the Core inflation rate stood at 2.10 percent in September 2024, a decrease of 0.17 percent compared to the 2.27 percent recorded in August 2024.

The average twelve-month annual inflation rate was 25.64 percent for the twelve months ending September 2024; this was 6.09 percentage points higher than the 19.55 percent recorded in September 2023.

The Urban consumers’ annual inflation rate in September 2024 on a year-on-year basis was 35.13 percent, indicating an increase of 6.46 percentage points compared to the 28.68 percent recorded in September 2023.

Similarly, the Urban month-on-month inflation rate increased to 2.67 percent in September 2024, showing a rise of 0.28 percent compared to the 2.39 percent recorded in August 2024.

The corresponding twelve-month average for the Urban inflation rate was 33.95 percent in September 2024; this was 9.84 percentage points higher than the 24.10 percent reported in September 2023.

Additionally, the rural areas’ headline inflation rate in September 2024 was 30.49 percent on a year-on-year basis; this was 5.55 percent higher than the 24.94 percent recorded in September 2023.

On a month-on-month basis, the rural inflation rate in September 2024 was 2.39 percent, up by 0.33 percentage points compared to 2.06 percent in August 2024, while the corresponding twelve-month average for the rural inflation rate in September 2024 was 29.76 percent, which was 7.97 percent higher than the 21.79 percent recorded in September 2023.

“The analysis of the states’ profiles shows that the all-item index for September 2024, on a year-on-year basis, was highest in Bauchi (44.83 percent), Sokoto (38.74 percent), and Jigawa (38.39 percent), while Delta (26.35 percent), Benue (26.90 percent), and Katsina (27.71 percent) recorded the slowest rise in headline inflation on a year-on-year basis.

“On the other hand, on a month-on-month basis, September 2024 recorded the highest increases in Sokoto (4.63 percent), Taraba (4.07 percent), and Anambra (3.74 percent), while Kwara (1.14 percent), Cross River (1.78 percent), and Lagos (1.82 percent) recorded the slowest rise in month-on-month inflation.

The analysis of the food index at state levels in September 2024, on a year-on-year basis, recorded the highest in Sokoto (50.47 percent), Gombe (44.09 percent), and Yobe (43.51 percent), while Kwara (32.45 percent), Rivers (32.80 percent), and Kogi (32.83 percent) recorded the slowest rise in food inflation on a year-on-year basis,” the NBS stated.

It added that “On the other hand, on a month-on-month basis, September 2024 food inflation was highest in Sokoto (5.94 percent), Taraba (5.76 percent), and Bayelsa (4.44 percent), while Kwara (0.88 percent), Cross River (1.29 percent), and Kogi (1.45 percent) recorded the slowest rise in food inflation.”

The Kaduna State Governor, Uba Sani, has expressed shock and deep sense of loss while paying condolences to the families of the Eid-el-Maulud auto crash victims.

The auto crash took a worse turn on Tuesday after the death toll rose from 25 to 40 people, mostly children.

The incident occurred on Sunday when a J5 bus carrying youngsters to celebrate the Eid-el Maulud lost control due to speeding and overloading, colliding with an articulated vehicle along the Saminaka Road in the Lere Local Government Area.

Initially, the Federal Road Safety Corps reported 25 fatalities and 48 injuries but disclosed on Tuesday that more victims succumbed to their injuries in the hospital, bringing the total death toll to 40.

While speaking on Tuesday, the state governor said, “This is a tragic loss of young lives, and we will do everything possible to support the affected families.”

He directed the state Commissioner of Health, Hajiya Umma K Ahmed, to ensure the surviving children received urgent and adequate medical attention.

Our correspondent gathered that Sani also planned to reach out to the families of the deceased to offer assistance, demonstrating his commitment to supporting those affected by the terrible incident.

PUNCH Metro reports that the tragic incident occurred around 1:00 pm on Sunday when a J5 bus carrying 63 children, mostly youngsters traveling to celebrate Eld El Maulud, collided with an oncoming articulated vehicle.

The Sector Commander of the Federal Road Safety Corps in the state, Kabiru Nadabo, confirmed the incident.

He said, “The driver of the J5 bus lost control due to speeding, resulting in the fatal crash. Fifteen children died instantly, while 48 others sustained varying degrees of injuries.”

However, Nadabo added that due to the nature of the injuries sustained during the crash, 10 more victims died bringing the toll number of fatalities to 25, adding that “more victims succumbed to their injuries in the hospital, bringing the total death toll to 40.”

Nadabo emphasised the importance of road safety measures, urging drivers to exercise caution and adhere to speed limits to prevent such tragedies.

“This accident serves as a stark reminder of the dangers of reckless driving. We urge drivers to exercise caution and adhere to speed limits to prevent such tragedies.”

An eyewitness who spoke to PUNCH Metro on the condition of anonymity described the scene as chaotic. “I saw the bus swerve out of control and collide with the articulated vehicle,” he said.

Newer Posts