The crypto space is vast, with thousands of digital assets designed to meet a wide range of needs and use cases. Among the largest and most popular cryptocurrencies are Monero and Ripple, each targeting unique market segments.

Although both are prominent players in the digital asset space, they differ fundamentally in terms of technology, purpose, and user base. Understanding these differences can help you make informed investment decisions about which cryptocurrency might be the best fit for you.

Now, let’s take a closer look at Monero (XMR) and Ripple (XRP) and then explore their differences to understand why each has gained popularity and the specific roles they play in the crypto ecosystem.

1. Purpose and Use Case

Monero (XMR):

Monero is known for its privacy and security. It was developed in 2014 with the sole motive of providing anonymous and untraceable transactions. Monero is focused on decentralization and anonymity, so it becomes the first choice of every user who prefers privacy in transactions.

Monero’s key feature is its privacy, ensuring that transaction details—like sender, receiver, and amount—are not visible to third parties. It utilizes advanced cryptographic techniques such as ring signatures, stealth addresses, and RingCT (Ring Confidential Transactions) to provide users with full control over their transaction privacy.

Users can also check out the XMR exchange on Exolix for a fast, safe, and anonymous way to trade XMR.

Ripple (XRP):

Ripple is designed to facilitate fast and cost-effective cross-border money transactions. Its native cryptocurrency, XRP, is intended to help financial institutions, banks, and service providers transfer money globally in an efficient manner. Unlike Monero, which focuses on privacy and anonymity, Ripple emphasizes efficiency and scalability.

RippleNet, the network that powers Ripple’s services, allows institutions to settle payments in just seconds, regardless of the currency or location. Ripple positions its products as a bridge currency, enabling quicker transactions compared to traditional payment systems like SWIFT.

2. Privacy and Anonymity

Monero (XMR):

Privacy lies at the heart of Monero. Every transaction via XMR is fully anonymous; it is, therefore, considered one of the most private cryptocurrencies available in the market today. Monero conceals both the sender and receiver identities, together with the amount transferred. By the implementation of technologies such as stealth addresses and RingCT, Monero ensures that each transaction is private and not traceable.

Ripple (XRP):

Unlike Monero, Ripple offers no features for privacy or anonymity. Ripple has been designed to be fully transparent and compliant with regulatory frameworks, thus making banks and financial institutions quite fond of it. Ripple’s ledger is public, which lets anyone see who is making the transaction; this is how Bitcoin’s blockchain works.

3. Decentralization

Monero (XMR):

Monero is a completely decentralized digital currency. It is based on the proof-of-work consensus algorithm, whereby miners validate the transactions on the network. Community-driven development also helped decentralize Monero: there is no central authority in control of the operations of Monero. Its open-source nature allows quite literally anyone to contribute to its development.

The mining algorithm RandomX is designed to be ASIC-resistant; the network can be mined using a simple CPU, further decentralizing it from large mining farms that dominate other networks.

Ripple (XRP):

Ripple often faces criticism for its centralized nature. Unlike Monero, Ripple Labs plays a significant role in the network’s development and controls much of it, using the XRP Ledger Consensus Protocol instead of traditional PoW or PoS methods.

The company also holds a large portion of the total XRP supply, which critics argue creates a single point of control. While this centralization makes Ripple appealing for financial institutions, it does not attract cryptocurrency purists who value decentralization.

4. Transaction Speed and Cost

Monero (XMR):

Monero transactions in general take up to a couple of minutes due to the additional cryptographic layers employed for privacy. While that is slower than many other cryptocurrencies, this delay is part of the bargain for the privacy that Monero enables.

Monero transaction fees normally stand at a low value but can change depending on network congestion and the size in terms of the amount of the transaction involved.

Ripple (XRP):

One of the major advantages of Ripple is its speed and low cost. A transaction on Ripple will take only a few seconds to settle. As such, Ripple is one of the fastest cryptocurrencies currently available for trading. This is very suitable for cross-border payments where normal systems take a number of days to settle.

Also, XRP transaction fees are very low and usually below a fraction of a cent. This makes Ripple not only swift but very affordable in the transfer of value, particularly over long distances.

5. Regulation and Compliance

Monero (XMR):

Monero was designed with several privacy features that had attracted regulatory scrutiny; for this reason, the coin has been labeled by various governments and financial institutions. Due to its anonymity, Monero has been delisted from certain exchanges in various regions around the world, as these privacy characteristics make tracking more difficult for regulators.

Ripple (XRP):

Ripple has consistently aimed to comply with regulations. In contrast to Monero, which deliberately seeks to avoid engagement with the current regulatory framework, Ripple is designed to operate within it. This approach makes Ripple particularly appealing to banks and financial institutions.

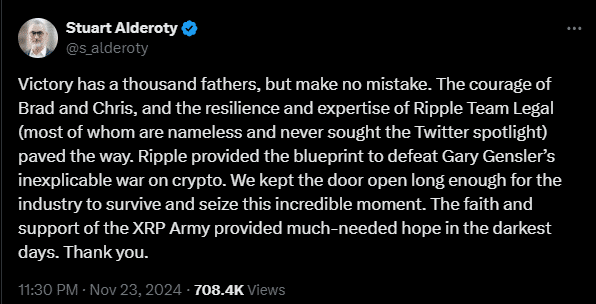

However, Ripple is also facing its own legal challenges, the most significant being a recent lawsuit filed by the U.S. Securities and Exchange Commission, which claims that XRP is an unregistered security.

Despite these challenges, Ripple is positioned as a cryptocurrency intended for institutional use rather than for individuals focused on privacy. Its strategy centers around collaborating with regulators rather than opposing them.