©2022 DopeReporters. All Right Reserved. Designed and Developed by multiplatforms

Tag:

inflation

Nigeria’s inflation rises to 34.80% in December as CPPE calls for monetary policy adjustments

by admin

Nigeria’s inflation rate surged to 34.80 percent in December 2024 from 34.60 percent in November.

This is according to the latest Consumer Price Index and inflation data released on Wednesday by the National Bureau of Statistics, NBS.

While the country’s inflation continues to rise, the Centre for the Promotion of Private Enterprise, CPPE, has identified tips for its moderation.

The December inflation data showed that the country’s inflation further rose marginally by 0.20 percent due to heightened demand for goods and services during the festive season.

On a year-on-year basis, the December inflation rate marked a significant increase of 5.87 percentage points compared to 28.92 percent in December 2023.

The untamed rise in the Nigeria’s inflation highlights the upward trajectory in consumer prices, driven by economic challenges such as currency depreciation, high energy costs and persistent supply chain disruptions.

“On a year-on-year basis, the headline inflation rate was 5.87 percent higher than the rate recorded in December 2023 (28.92 percent). This shows that the headline inflation rate (on a year-on-year basis) increased in December 2024 compared to the same month in the preceding year (i.e., December 2023),” NBS stated.

Meanwhile, NBS said Nigeria’s food inflation dropped marginally to 39.83 percent in December 2024 from 39.93 percent in November on a year-on-year basis.

CPPE reacts

Reacting, the Chief Executive Officer at the Centre for the Promotion of Private Enterprise, Muda Yusuf, said the inflationary pressures continue to be a troubling feature of the Nigerian economy as reflected in December’s inflation rate.

“Though the increase in the December headline inflation was marginal at 0.2% compared with November inflation figures.”

However, Yusuf is optimistic that Nigeria’s inflation would have a positive outlook in 2025 due to moderation in exchange rate volatility and improvement in foreign reserves.

“Meanwhile, the inflation outlook for 2025 promises to be positive for the following reasons: Sustained moderation in exchange rate volatility and improvements in foreign reserves.

“Prospects of easing geopolitical tensions with the inception of the Trump presidency in a few days time.

“And a strong base effect, given the high inflationary pressures experienced in 2024,” he stated.

The economic think tank group, CPPE, also decried the current fixation of the National Assembly on revenue, especially the arbitrary revenue targets for ministries, departments, and agencies.

“Excessive pressure on MDAs to boost revenue and increase IGR has profound inflationary implications.

“The reality is that such pressures are invariably transmitted to investors in the form of higher fees, levies, penalties, import duties, regulatory charges, etc. These outcomes are in conflict with government aspirations to boost investment, curb inflation, and create jobs.

“Revenue targets should be based on empirical studies, absorptive capacity of the economy, and due consideration of the wider economic implications.

“Obsession with revenue would hurt investments, worsen inflationary pressures, aggravate poverty, and impede economic growth. There should be a careful balancing act between revenue growth aspirations, desire to boost investment, and commitment to moderate inflation,” CPPE stated.

How Nigeria’s inflation rate can drop – CPPE

CPPE highlighted that Nigeria’s inflation can moderate on pause of monetary tightening policy by the Central Bank of Nigeria, reducing fiscal risks.

“To ensure a further moderation in inflationary pressures, CPPE recommends as follows:

“Pause on monetary policy tightening and interest rate hikes by the CBN to reduce business operating costs.

“Reduction in fiscal risks to macroeconomic stability through a reduction in fiscal deficit and deceleration in growth of public debt,” the CPPE stated.

Former presidential candidate Pat Utomi has emphasized that President Bola Tinubu must take intentional steps to lower food prices if he hopes to combat inflation in the country.

According to reports, Tinubu, in his New Year’s address, vowed to prioritize food production and achieve economic stability through policies aimed at reducing inflation and ensuring food security.

The President also expressed his administration’s commitment to cutting inflation from its current 34.6% to 15%.

In an interview with Punch, Utomi highlighted that Tinubu’s success depends on his administration’s ability to address insecurity, provide incentives for farmers, and implement robust agricultural policies to establish a stable and sustainable food production system.

He cautioned against relying on large-scale food imports as a solution, warning that it could exacerbate Nigeria’s foreign exchange challenges and harm local agricultural productivity.

Utomi further explained that imported food would remain expensive due to poor exchange rates, and subsidies on such imports would negatively impact the country’s capacity for sustainable food production.

“There is hunger, real hunger, in the land,” Utomi said. “One of the biggest contributors to inflation is food price inflation. It significantly affects how people feel and their ability to handle other challenges.”

He urged the government to introduce deliberate policies to reduce food costs by investing in agriculture, offering substantial incentives to attract young people to farming, and addressing insecurity urgently.

To tackle insecurity, Utomi proposed establishing special agricultural security forces, such as forest rangers, to safeguard farmlands and prevent conflicts between farmers and herders or attacks by bandits.

Additionally, he called on the government to support farmers in implementing irrigation systems to enable year-round farming.

The Chief Executive of Financial Derivatives and popular economist, Bismark Rewane said President Bola Ahmed Tinubu’s 15 percent inflation target in 2025 is unrealistic and a mere aspiration.

Rewane disclosed on Channels Television’s program on Thursday.

DAILY reports that during Tinubu’s N49.7 trillion budget presentation before the National Assembly on December 18, 2024, he expressed optimism that Nigeria’s inflation rate would decline from 34.60 percent to 15 percent in 2025.

However, Rewane said the President’s target isn’t realistic.

According to him, Nigeria’s inflation can decline to 25 or 27 percent, but the 15 percent is unrealistic.

“Well, the target is an aspiration; the reality that we think is inflation could reduce from approximately 35 percent to somewhere like 27 percent or 25 percent, but a 15% rate on inflation is very bullish and aspirational, but we are free to have our aspirations.

“We deal in the world of reality, and in the world of reality, we see more of 27% to 25%. I would rather bet on that than bet on much more optimistic scenarios,” he said.

When Tinubu was sworn in as Nigeria’s president in May 2023, Nigeria’s inflation rate was 22.41 percent, according to official numbers by the National Bureau of Statistics, NBS.

The inflation rate rose astronomically to 34.6 percent in November 2024, more than 12 percent higher, a development that economic experts have attributed to Tinubu’s twin policies of petrol subsidy removal and unification of the foreign exchange rates.

FG’s economic reforms should reduce high inflation, interest rates, address business shutdowns in 2025 -LCCI

by admin

.Says proposed National Credit Guarantee Coy ‘ll improve access to credit

COMFORT EKELEME, Business Editor

The current Federal Government’s economic reforms should deliver on easing the high rate of inflation, the burden of high interest rates on businesses, business shutdowns, and job losses, as well as the resolution of persistent challenges facing power supply, national security, and food production in the country.

The Lagos Chamber of Commerce and Industry, LCCI, which threw the challenge on Thursday also described the proposed National Credit Guarantee Company announcement as representing a critical step toward unlocking access to credit, particularly for women, youth, and small-scale enterprises.

This was contained in a statement signed by its Director-General, Dr. Chinyere Almona, LCCI in reaction to President Bola Ahmed Tinubu’s New Year speech.

It noted that the President highlighted critical themes relevant to achieving the nation’s economic goals, addung that the themes become more relevant in the global economy through more collaborations with the international community, and improving the business environment for the private sector to thrive in 2025.

Part of the statement read: “His address underscores both opportunities and challenges as we embark on the journey to achieving the ambitious goal of a trillion-dollar economy.

“While we commend the government’s efforts so far towards achieving the successes highlighted in his speech, we reiterate our concerns about the consistency of policies and the reforms currently driven by the government.

“We expect the reforms to deliver on easing the high rate of inflation, the burden of high interest rates on businesses, business shutdowns, and job losses, and the resolution of persistent challenges facing power supply, national security, and food production in our nation”.

The LCCI noted that, the National Credit Guarantee Company announcement represents a critical step toward unlocking access to credit, particularly for women, youth, and small-scale enterprises.

According to LCCI, if implemented effectively and efficiently, it can boost demand for goods from agro-producers and industries, and this can improve the capacity utilization of manufacturers and the capacity to create more jobs in the mid-term.

It, however, emphasized the need for swift operationalization and a transparent framework to avoid bureaucratic bottlenecks.

It stated, “The President’s desire to work more collaboratively with the international community is a good idea.

“However, for Nigeria to really explore inherent opportunities in international relations, we must do more to create an enabling business environment attractive enough to boost our Foreign Direct Investments (FDI) this year.

“All our diplomatic efforts should be geared towards boosting foreign trade, especially when we can boost our non-oil exports to the levels of recording trade surpluses in 2025.

“We need critical investments in the telecommunications sector to boost this government’s digital transformation agenda. Similarly, the Compressed Natural Gas (CNG) initiative requires huge investment in infrastructure.

“Both digital transformation and energy transition are quite critical to achieving the level of industrialization required to power a one trillion economy,” it added.

The President’s focus on ethical citizenship and shared values underscores the role of social cohesion in nation-building.

The upcoming National Values Charter and Youth Confab are commendable efforts to galvanize citizens and foster patriotism.

For the business community, a stable and cooperative societal framework is foundational for sustained economic activity. Beyond the show of commitment to a charter of shared values, we believe that the rule of law remains the most important guarantee of human rights protection and the best template for justice and fairness in a democratic state.

“Let us do all within our means and power to institute a culture of avoiding controversies and uncertainties by charting a sure path for our policies, regulations, and budget implementation.

The budget assumptions are ambitious but achievable if we consistently drive our economic agenda towards our set goals,” it stated.

For a better society

_______________________________

Follow us across our platforms:

Instagram – https://www.instagram.com/championnewsonline/

Facebook – https://web.facebook.com/championnewsonline

LinkedIn – https://www.linkedin.com/company/champion-newspapers-limited/

https://x.com/championnewsng/

You can also like and comment on our YouTube videos.

https://youtu.be/QIBfD1tT80w?si=R4Qf3so2LxYu3GC2

January 1, 2025

Trending now

2025: Tinubu promises massive food production, 15% reduction in inflation

2025: Sanwo-Olu applauds residents’ resilience, says Lagos future limitless

Soludo promises accelerated transformation of Anambra in 2025

FG has adequate budgetary provisions to meet foreign, local debt obligations –…

Ede, Egbedore, Ejigbo Traditional Rulers endorse Governor Adeleke for second term

My plans for NDDC in 2025 – Ogbuku

Latest News from Champion Newspapers, January 1, 2025

Gov Diri mourns Elizabeth Bidei, commissioner for women, children

Navy donates food items to orphanage in Anambra

We respond to issues of peace, security, well-being of Rivers people, Fubara…

Nigeria’s imported food inflation soared to 42.29% in November 2024, as revealed by the Consumer Price Index report from the National Bureau of Statistics.

On a monthly basis, the inflation rate climbed from 40.96% in October 2024, reflecting a 1.33 percentage point increase within a single month.

The data underscores a persistent upward trend in imported food inflation throughout 2024, starting at 26.29% in January. By October, the rate had exceeded 40%, with November’s 42.29% figure being the highest in two years.

This steep rise has been linked to several factors, including currency devaluation, global supply chain disruptions, and inefficiencies in domestic policy execution. Efforts by the Federal Government to address the crisis, such as introducing a duty waiver on imported food, have faced significant delays.

In July 2024, the government announced a 150-day duty-free window for importing key food items like maize, husked brown rice, wheat, and cowpeas. This initiative aimed to lower import costs and make staple foods more affordable by subjecting imported commodities to a Recommended Retail Price.

However, implementation has been hampered by bureaucratic hurdles. According to The PUNCH, the average price of imported high-quality rice has surged by 144.77% year-on-year due to delays in enforcing the duty-free policy.

Since the policy’s announcement, the price of one kilogram of imported rice has risen by 3.21%, increasing from ₦2,329.05 in July to ₦2,403.86 in September.

By Kenechukwu Aguolu

President Bola Ahmed Tinubu GCFR, presented the Proposed 2025 Budget of Restoration, titled “Securing Peace, Rebuilding Prosperity,” to a joint session of the National Assembly on Wednesday, December 18, 2024. as required by the Nigerian Constitution. As expected. there have been divergent opinions about the appropriation bill with many referring to it as overambitious. While the budget is achievable, the projected reduction in Inflation is quite ambitious and may not be realized. More emphasis should have been placed on economic diversification.

The objective of reducing inflation to 15% which is a 59% decrease in a single year is particularly challenging. The increase in the value of the Naira, increased food production, and proper monetary/fiscal policies will surely drop inflation. However, achieving such a steep decline will not be feasible unless the value of the naira rises significantly; beyond what was projected in the appropriation bill.

Apart from agriculture, other sectors like tourism and mining can drive economic growth and resilience. Developing the Mining sector offers significant revenue-generation opportunities and will also lead to the establishment of more industries in Nigeria in a bid to take advantage of nearness to raw materials. The United Arab Emirates, France, Spain, etc, make massive revenue from tourism. Therefore, the Government should have demonstrated a greater economic diversification drive in the budget. Insecurity has hindered the development of mining and tourism in Nigeria.

Stabilizing the exchange rate at N1,500/US$ will require amongst other things; increased foreign exchange inflows through foreign portfolio/direct investments,

improved balance of trade, increased domestic oil production and refining capacity. Policies aimed at boosting exports and reducing dependency on imports are crucial for achieving currency stability and strengthening the naira.

Addressing insecurity remains fundamental to achieving the budget’s objectives. Insecurity continues to undermine agricultural productivity, deter investment, and disrupt infrastructure projects. A peaceful and stable environment is essential for economic growth and the creation of opportunities for citizens. The administration’s allocation of N4.91 trillion to defense and security underscores its acknowledgment of this challenge. However, addressing insecurity will require a comprehensive approach that combines military interventions with community engagement and socio-economic initiatives.

The 2025 Appropriation Bill, which has scaled second reading at the National Assembly, outlines an ambitious vision for Nigeria’s development. Critical to its success are inflation reduction, economic diversification, exchange rate stability, and improved security. The Government may wish to revisit the inflation projection and economic diversification drive. The National Assembly is expected to make adjustments to the bill during its review before passing it.

Nigeria’s inflation rate surged to 34.6% in November 2024 from 33.8% in October, according to the latest Consumer Price Index (CPI) report by the National Bureau of Statistics (NBS).

This represents a year-on-year increase of 6.4 percentage points compared to 28.2% in November 2023.

On a month-on-month basis, inflation rose by 2.638% in November, slightly lower than October’s 2.64%. The NBS noted that although prices are increasing, the pace of monthly price growth slowed slightly.

Food inflation crisis

Food inflation climbed sharply to 39.93% in November 2024, compared to 32.84% in November 2023. Month-on-month food inflation also saw a modest rise to 2.98%, up from 2.94% in October.

Key contributors to the surge in food prices included staples such as yams, maize, rice, guinea corn, and vegetable oil, as well as items like dried fish, powdered milk, and frozen meat.

Over the past 12 months, the average food inflation rate reached 38.67%, marking an increase of 11.58 percentage points compared to 27.09% in November 2023.

Inflation based on states

Food inflation rates varied significantly across states:

- Highest year-on-year rates: Bauchi (46.21%), Kebbi (42.41%), and Anambra (40.48%).

- Lowest year-on-year rates: Delta (26.47%), Benue (28.98%), and Katsina (29.57%).

- Highest month-on-month increases: Yobe (5.14%), Kebbi (5.10%), and Anambra (4.88%).

- Lowest month-on-month increases: Adamawa (0.95%), Osun (1.12%), and Kogi (1.29%).

The NBS attributes the trend to increased costs of essential staples, highlighting the need for targeted policies to address food security and price stabilization.

The National Bureau of Statistics (NBS) reported Nigeria’s headline inflation rate rose to 34.60 per cent in November 2024, a 0.72 percentage point increase from October’s 33.88 per cent.

The NBS disclosed this in its Consumer Price Index (CPI) and Inflation Report for November, which was released in Abuja on Monday.

On a year-on-year basis, the headline inflation rate in November 2024 was 6.40 per cent higher than the 28.20 per cent recorded in November 2023.

The report also revealed that, on a month-on-month basis, the inflation rate for November 2024 was 2.63 per cent, which was slightly lower than the 2.64 per cent recorded in October.

The NBS attributed the increase in the headline inflation to rising prices in various sectors, including food and non-alcoholic beverages, housing, water, electricity, gas, clothing, transport, education, health, and other goods and services.

The average CPI for the 12 months ending November 2024 stood at 32.77 per cent, indicating an 8.76 per cent increase from the 24.01 per cent recorded in November 2023.

Food inflation in November 2024 rose to 39.93 per cent on a year-on-year basis, up from 32.84 per cent in November 2023.

The increase in food prices was attributed to higher costs of yam, rice, maize, and other staples, as well as vegetable oil, fats, and processed foods.

On a month-on-month basis, food inflation increased by 2.98 per cent, slightly up from the 2.93 per cent recorded in October 2024.

Core inflation, which excludes volatile agricultural produce and energy, stood at 28.75 per cent in November 2024, a 6.36 per cent increase from 22.38 per cent in the previous year.

The urban inflation rate in November 2024 was recorded at 37.10 per cent, up from 30.21 per cent in November 2023, while the rural inflation rate was 32.27 per cent, compared to 26.43 per cent in the same period last year.

On a month-on-month basis, the urban inflation rate increased to 2.77 per cent, while the rural inflation rate rose by 2.51 per cent.

State-level analysis revealed that Bauchi had the highest year-on-year inflation rate at 46.21 per cent, followed by Kebbi at 42.41 per cent, and Anambra at 40.48 per cent.

On the other hand, Delta, Benue, and Katsina recorded the slowest rises in inflation. Food inflation was highest in Sokoto at 51.30 per cent, with Yobe and Edo following closely.

Yobe also recorded the highest month-on-month food inflation at 6.52 per cent, while Borno, Adamawa, and Kogi had the slowest increases.(NAN)

Nigeria’s inflation rate for the month of November 2024 rose to 34.60 percent from 33.88 percent in October, indicating worsening hardship for Nigerians.

This is according to the National Bureau of Statistics’ latest Consumer Price Index and Inflation for November.

The report showed that the country’s headline or all-items inflation increased by 0.72 percent on a month-on-month basis.

Also, Nigeria’s inflation increased by 6.40 percent compared to 28.20 percent recorded in November 2023.

The rise in prices of food items pushed food inflation to 39.93 percent in November from 39.19 percent in October.

The report also showed that urban and rural inflation stood at 37.10 percent and 32.27 percent, respectively.

The increase in Nigeria’s inflation comes amid the Central Bank of Nigeria’s monetary policy interventions.

The apex bank, led by Olayemi Cardoso, consistently had a hike in interest rates with rising inflation as justification.

The latest hike was in November when the CBN 297th Monetary Policy Committee decided to raise the country’s interest rate to 27.50 percent from 27.25 percent.

Despite CBN’s monetary interventions, the prices of goods and services have remained elevated, impacting the cost of living for the majority of Nigerians.

Meanwhile, in July and August 2024, Nigeria witnessed declining inflation rates.

Nigeria’s inflation figure for November is expected to be released by the National Bureau of Statistics between Sunday and Monday, DAILY POST reports.

The NBS, the country’s official data custodian, usually releases its monthly consumer price index and inflation data on the 15th day of the preceding month.

Recall that Nigeria’s headline inflation soared to 33.88 percent in October 2024.

At the same time, food inflation increased to 39.16 percent, indicating a surge in the prices of food.

The increase in Nigeria’s inflation comes amid the Central Bank of Nigeria’s monetary policy interventions.

The apex bank, led by Olayemi Cardoso, consistently had a hike in interest rates with rising inflation as justification.

The latest hike was in November, when the CBN 297th Monetary Policy Committee decided to raise the country’s interest rate to 27.50 percent from 27.25 percent.

Despite CBN’s monetary interventions, the prices of goods and services have remained elevated, impacting the cost of living for Nigerians.

Nigeria’s inflation rate climbed to 33.88% in October 2024, up from 32.70% recorded in September, according to the National Bureau of Statistics (NBS).

The surge, highlighted in the NBS Consumer Price Index and Inflation report released on Friday, reflects rising costs of essential goods and services.

On a month-on-month basis, the headline inflation rate stood at 2.64% in October. Food inflation saw a sharp increase, hitting 39.16%, compared to 37.77% in September, as prices of staples continue to spike.

The inflation surge coincides with a steep rise in energy costs, particularly petrol prices. Reports show that the petrol pump price skyrocketed to over ₦1,030 per litre in October, up from ₦617 in August, putting additional pressure on households and businesses.

The Central Bank of Nigeria’s Inflation Expectation Survey, released earlier in the week, had already forecasted a further increase in inflation, citing the escalating cost of living.

The report underscores growing concerns about the impact of inflation on Nigeria’s economy, as consumers struggle to cope with skyrocketing food and fuel prices, with ripple effects expected to persist in the coming months.

Food and petrol price hikes have pushed Nigeria’s inflation to 33.88 percent in October 2024, from 32.70 percent recorded in the previous month.

The National Bureau of Statistics, NBS, disclosed this on Friday in its Consumer Price Index and Inflation report for October 2024.

Looking at the data, month-on-month, Nigeria’s headline inflation rate in October 2024 was 2.64 percent.

This comes as food inflation rose to 39.16 percent in October 2024, from 37.77 percent in September 2024.

The Central Bank of Nigeria’s Inflation Expectation Survey, released on Tuesday, predicted Nigeria’s inflation to rise.

DAILY POST reports that energy cost rise in the period under review, with petrol pump price rising above N1,030 per litre in October, from N617 in August 2024.

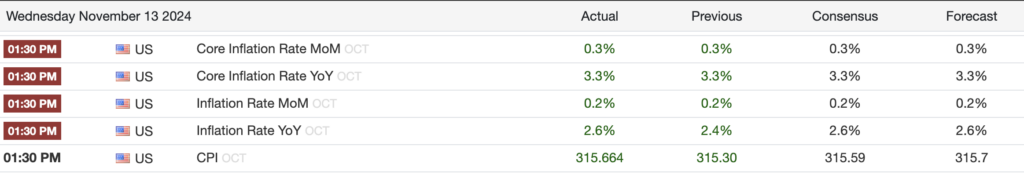

The US Bureau of Labor Statistics released October’s Consumer Price Index data today. The annual inflation rate increased to 2.6% from the previous 2.4%, aligning with forecasts. Month-over-month, the inflation rate remained steady at 0.2%, matching both prior figures and expectations.

The Core Inflation Rate, excluding food and energy prices, remained at 3.3% year over year and rose by 0.3% month over month, consistent with consensus estimates. These figures indicate that underlying inflation pressures remain stable.

Bitcoin rose 1.2% immediately after the data was released and is trading at $88,400 as of press time.

The post US inflation stable coming in at expected 2.6%, Bitcoin breaks over $88,000 again appeared first on CryptoSlate.

Newer Posts