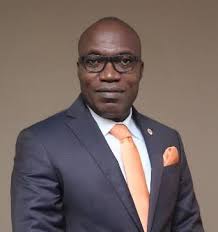

The Managing Director and Chief Executive Officer of Cowry Assets Management Ltd, Johnson Chukwu, has issued a stark warning about the precarious state of Nigeria’s banking sector.

Speaking on the rising tide of non-performing loans (NPLs) and the need for urgent recapitalisation, Chukwu painted a sobering picture of a financial landscape teetering on the edge.

“I can say, without fear of contradiction, that the effective non-performing loan ratio in the Nigerian banking industry exceeds the regulatory threshold of five per cent.”

Chukwu remarked. He pointed to Central Bank of Nigeria (CBN) for – bearance measures, which have allowed banks to defer recognising certain distressed loans, as masking the true depth of the crisis.

The recent devaluation of the naira and escalating exchange rates, he argued, have further eroded the quality of bank loan portfolios.

Chukwu, who was the keynote speaker at the just concluded 2024 Conference of the Capital Market Correspondents Association of Nigeria (CAMCAN), emphasised that these developments have put banks under mounting pressure to bolster their capital buffers.

“Operationally, the level of non-performing loans has increased significantly, and this requires additional capital to absorb the shocks,” he stated.

He underscored the critical role of recapitalization in equipping banks to meet regulatory standards and maintain stability in the face of burgeoning financial risks.

Drawing attention to the broader economic fallout, the renowned economist and investment adviser highlighted significant losses reported by publicly listed companies, including MTN and Nigerian Breweries, attributing much of the downturn to the harsh economic climate.

Chukwu also explained the importance of strengthening banks’ capital adequacy ratios to ensure resilience against future shocks.

Please follow and like us: