The over two-year-old cash insufficiency in the Nigerian banking sector was the aftermath of the Naira redesign policy of the Godwin Emefiele-era Central Bank of Nigeria (CBN). In this report, PAUL OGBUOKIRI notes that despite the N1.35 billion sanctions recently imposed on nine banks by CBN, Deposit Money Banks still pre-programme their ATM machines to discriminatively ration cash among their customers and customers of other banks

CBN response to banks’ two years of ‘no cash’

In the last two years, bank customers have experienced difficulty trying to get cash from banks’ Automated Teller Machines (ATMs), Point of Sale, POS agents.

To put to an end to the cash insufficiency in the Nigerian banking system without jeopardising the cashless policy, the Central Bank of Nigeria (CBN) recently imposed a fine of N1.35 billion on nine commercial banks for failing to make Naira notes available through Automated Teller Machines (ATMs) during the Yuletide season.

Each bank was fined N150 million for non-compliance, in line with the CBN’s cash distribution guidelines, following spot checks on their branches.

The enforcement action followed repeated warnings from the CBN to financial institutions to guarantee seamless cash availability, particularly during periods of high demand.

The affected banks included Fidelity Bank Plc, First Bank Plc, Keystone Bank Plc, Union Bank Plc, Globus Bank Plc, Providus Bank Plc, Zenith Bank Plc, United Bank for Africa Plc, and Sterling Bank Plc.

The Acting Director of Corporate Communications at the CBN, Mrs. Hakama Sidi Ali, confirmed the development.

She said: “The CBN will not hesitate to impose further sanctions on any institution found violating its cash circulation guidelines.”

She said the apex bank’s investigations and monitoring would continue to scrutinise cash hoarding and rationing, both at bank branches and by Point-of-Sale (PoS) operators.

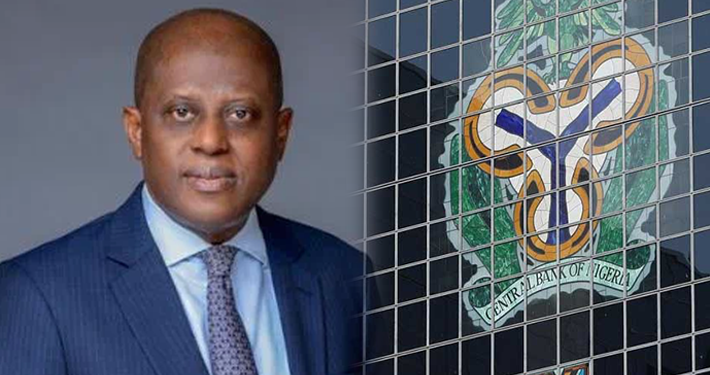

CBN Governor, Olayemi Cardoso, in his address at the Annual Bankers’ Dinner of the Chartered Institute of Bankers of Nigeria (CIBN) in November 2024, warned banks to strictly adhere to cash distribution policies or face severe penalties.

He underscored the CBN’s commitment to maintaining a robust cash buffer to meet Nigerians’ needs.

“Our focus remains on fostering trust, ensuring stability, and guaranteeing seamless cash circulation across the financial system,” Cardoso had said.

The CBN urged all financial institutions to comply with its guidelines, warning that further violations would attract swift and decisive sanctions.

No respite for customers at bank ATM machines

Days after the Central Bank fined the nine banks for refusing to make enough cash available to their customers at their ATM and over the counter, Sunday Telegraph can report that while there is noticeable improvement, though far below the pre-Naira redesign era, on payment of cash over the counters by most of the banks, cash rationing still persists, even as a customer at First City Monument Bank (FCMB) along Egbe Road, Okota, said that he cannot as matter of certainty say he can get a certain amount of cash over the counter from his bank at every visit to the bank.

“What you get today is not what you will get tomorrow and it has not nothing to do with your needs. They say it depends on the amount of cash available to them any day.”

At banks’ ATMs, the experience is discriminatory in favour of the customers of the bank against other banks customers who wish to withdraw money from their ATM.

Mary Isaac, a customer of a first generation bank, whose account is domiciled at the bank’s branch at Okota roundabout in Lagos State, said that when she goes to the ATM machines belonging to her bank, she can withdraw as much N40, 000 in one day but a non-customer can only withdraw N5, 000 in a day from the same ATM machine.

“The privilege I enjoy in my bank, I don’t enjoy it in other banks. If I go to the bank (name withheld) across the road, their customers can withdraw as much as N100, 000, but their system can only allow me to withdraw just N20,000.”

A security men at the gate of the bank after asking our correspondent who visited the bank if he wants to withdraw, further asked what amount he wanted to withdraw and whether he was a customer of the bank.

“If you have our bank ATM, you can withdraw as much as N100,000 but if you are holding the ATM of other banks, you can only withdraw N20, 000,” he said.

He also told our correspondent that it is the policy of the bank. “All the banks are operating that way. There is no cash. That is why they give priority to their customers”.

According to him, the ATM machines have been programmed to function that way. “There is nothing we can do about it unless the bank management decides to change the policy. The IT people will reprogramme the machines accordingly,” the security man, who simply gave his name as Isyaku, said.

In a similar development, a PoS operator, Mummy Bekky, who has her kiosk under the Ikeja Bridge, told Sunday Telegraph that they had been managing to navigate through the new antics of the banks favouring their customers with higher amounts of cash.

According to her, the method she has devised to source enough cash, which she uses to operate her business daily is by registering as a customer of as many banks that have branches within her area in Ikeja.

“I have 10 ATM cards. First thing in the morning, I will comb the banks. All of them have their cards. Before I have gone to 10 banks, I would have gotten enough cash for my business for the day. Any amount you want, I can deliver it so far as it is not above the CBN limit,” she said.

She disclosed that though she can now be able to source cash through this rigourous means, they may not be able to reduce their charges which went up about 100 per cent in December. The reason, she said, is the recent levy imposed on their every N10,000 transaction by the Federal Government.

Cardoso urge customers to report cash withdrawal issues at ATMs

To further maintain their oversight on banks and ensure they make cash available to customers, the Central Bank of Nigeria (CBN) called on bank customers to report any difficulties encountered while withdrawing cash from bank branches or ATMs, effective December 1, 2024.

This directive was issued by Olayemi Cardoso, CBN governor, during the 2024 annual bankers’ dinner organized by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos.

“Effective December 1, 2024, customers are encouraged to report any difficulties withdrawing cash from bank branches or ATMs directly to the CBN through designated phone numbers and email addresses for their respective states,” Cardoso said.

He further emphasised that financial institutions found engaging in malpractices or deliberate acts of sabotage would face stringent penalties.

Cardoso assured Nigerians that the CBN remains committed to maintaining a robust cash buffer to meet the country’s needs, particularly during high-demand periods such as the festive season and year-end. He said this move aims to ensure seamless cash flow while fostering trust and stability in the financial system.

“The payment system vision initiative for 2025 will further enhance confidence in the nation’s payment system,” the CBN governor noted.

Cardoso also highlighted the CBN’s efforts to improving payment gateways, assuring Nigerians that delays in settling financial transactions would be addressed by 2025.

“Trust is fundamental to fostering digital transactions,” he said, emphasizing the importance of preserving consumer confidence. He noted that delays often disproportionately affect vulnerable populations and warned that the CBN would apply penalties to non-compliant institutions to safeguard consumer trust and ensure swift redress mechanisms.

Key initiatives for 2025 included implementing an open banking framework, advancing contactless payment systems, and expanding the regulatory sandbox. Additionally, the CBN plans to issue revised guidelines for agency banking and strengthen electronic payment channels.

Cardoso also stated that Nigeria was on track to exit the Financial Action Task Force (FATF) grey list by the second quarter (Q2) of 2025.

He said enforcement plans against money laundering; cybercrime, fraud, and corruption are being intensified.

Further action on cash sufficiency

In the hopes of enhancing transparency and accountability in the banking sector, the Governor of the Central Bank of Nigeria announced a new Compliance Department at the apex bank.

Cardoso stated this while speaking at the launch of the 2025 macroeconomic outlook of the Nigerian Economic Summit Group.

Cardoso said that the new department, which would commence operations at the end of February, aligns with the apex bank’s broader goals to restore confidence in Nigeria’s financial industry.

“The CBN has taken the transformative step of setting up a compliance department with the objective of addressing past challenges, aligning with global standards, and building a more transparent financial sector that can drive Nigeria’s economic growth and development, Cardoso said.

“This department will be inward-facing and outward-facing as well. The department will be functional by the end of February.”

The announcement comes a day after the bank approved the release of the Nigerian Foreign Exchange (FX) Code, a move aimed at achieving a similar objective of fostering ethical conduct within the nation’s FX market.

Cash supply to banks

Meanwhile, without prejudice to all the efforts of the Central Bank to ensure banks make cash available to customers at the time they need it, the Association of Senior Staff of Banks, Insurance, and Financial Institutions has again blamed the apex bank for the cash shortages in the banking sector, saying the Central Bank was yet to meet the cash demands of commercial banks.

ASSBIFI President, Olusoji Oluwole, noted the dire impact of cash scarcity, particularly as the government makes efforts to reboot the economy which was dragged down by the twin policy of fuel subsidy removal and floating of the Naira currency.

“In terms of (the cash) scarcity, this is something that has not ended since the redesign of the naira,” Oluwole said.

Oluwole explained that banks have only two primary sources of cash – the CBN and retailers.

“Banks have only two sources of cash: the CBN and retailers. The CBN has not met banks’ demands, and retailers often sell cash for profit, making it harder for banks to access funds,” he explained.

He noted that the apex bank has failed to meet the cash demands of banks while retailers profit by selling cash instead of depositing it back into the banking system.

He called on the Central Bank to live up to its responsibility of providing the banks with adequate cash and the issue of non-compliance will be a thing of the past.

Please follow and like us: