Zenith Bank Plc’s track records of sustained growths and superior returns to investors have endeared the financial services group to the investing public.

Group Managing Director, Zenith Bank Plc, Dr. Adaora Umeoji, said the bank’s growth plans, strategic goals and historical market performance are attractions to investors.

At an interactive session with capital market stakeholders and investors, Umeoji outlined that the group would rely on its track records at the stock market and its operational performance as it embarks on recapitalisation drive.

According to her, with its solid risk management practices, regulatory compliance, capital adequacy, and low levels of non-performing loans, Zenith Bank would easily achieve its recapitalisation targets.

Umeoji highlighted the bank’s robust financials, including tier-1 capital of N1.8 trillion, shareholders’ funds of N2.3 trillion, market capitalisation of N1.3 trillion, and a profit after tax of N796 billion for the year ended December 2023.

She said the bank remains confident in its ability to deliver superior value to investors, owing to a high-quality board, strong management, and a solid corporate culture.

She also outlined future plans to promote financial inclusion, expand corporate and retail banking through advanced technology, and establish a fintech subsidiary, ZenPay, to drive profitability. Additionally, the bank aims to expand into France and the Francophone African region.

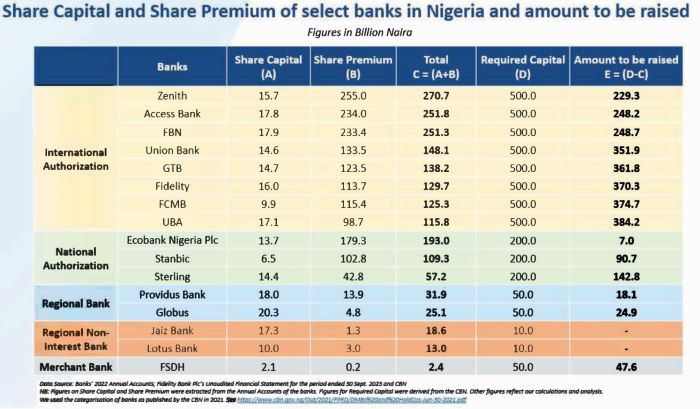

“Zenith Bank is set to raise capital from the market, targeting N230 billion, with N270.7 billion already secured, making it the least amount to raise among peers. We possess the capacity, network, balance sheet, human capital, and track record to achieve this. Our advanced technology will ensure seamless processes and integration,” Umeoji said.

Chief Financial Officer, Zenith Bank Plc, Dr. Mukhtar Adam pointed out that the bank’s compound annual growth rate (CAGR) in revenue has exceeded 27 per cent over the past five years.

“This growth continues annually. Despite Nigeria’s recession during this period, we maintained growth. Over the past five years, our profit before tax has grown by about 28 per cent,” Adam said.

Executive Director, Zenith Bank Plc, Dr. Henry Oroh highlighted the bank’s digital transformation and future direction with focus on financing small and medium enterprises and trade.

“We are investing in technology to build world-class solutions that enhance customer experience and market penetration. We are also addressing cyber-security issues by developing a network of tech products with zero vulnerabilities, including firewalls and other protections,” Oroh said.

Key extracts of the audited results and accounts for the year ended December 31, 2023, Zenith Bank achieved a significant growth of 125 per cent in gross earnings, from N945.6 billion in 2022 to N2.132 trillion in 2023. This growth resulted in a 180 per cent increase in profit before tax, from N284.7 billion in 2022 to N796 billion in 2023, and a 202 per cent increase in profit after tax, from N223.9 billion to N676.9 billion.

The increase in gross earnings was driven by growth in interest and non-interest income. Interest income rose by 112 per cent, from N540 billion in 2022 to N1.1 trillion in 2023, while non-interest income grew by 141 per cent, from N381 billion to N918.9 billion. The growth in interest income was due to the expansion of risk assets and their effective repricing, as well as higher yields on interest-bearing instruments. Non-interest income growth was driven by significant trading gains and foreign currency revaluation gains.

Zenith Bank’s cost of funds rose from 1.9 per cent in 2022 to three per cent in 2023 due to a high interest rate environment, while interest expenses increased by 135 per cent, from N173.5 billion in 2022 to N408.5 billion in 2023. Despite a 32 per cent increase in operating expenses in 2023, the Group’s cost-to-income ratio improved significantly from 54.4 per cent in 2022 to 36.1 per cent in 2023, thanks to improved top-line performance. Return on Average Equity (ROAE) increased by 118 per cent, from 16.8 per cent in 2022 to 36.6 per cent in 2023, driven by higher gross earnings. Return on Average Assets (ROAA) also grew by 95 per cent, from 2.1 per cent to 4.1 per cent.

Zenith Bank recently won the Best Commercial Bank, Nigeria, at the World Finance Banking Awards 2024 for the fourth consecutive year. The bank also received the Best Corporate Governance, Nigeria, award for the third year running. These awards, published in the Summer 2024 issue of World Finance Magazine, recognised the bank’s financial performance, customer service, sustainability initiatives, and corporate governance practices.

Umeoji said the awards reflected the group’s commitment to excellence, adherence to global best practices, and dedication to delivering superior value through innovative products and services.

“Our consecutive awards demonstrate the dedication of our staff, the loyalty of our customers, and the support of our shareholders. We remain committed to setting industry benchmarks and driving excellence across all operations,” Umeoji said.

She dedicated the awards to Founder and Chairman Dr. Jim Ovia, CFR, for his leadership, and expressed gratitude to the board, staff, and customers. World Finance provides comprehensive coverage and analysis of the financial industry, international business, and the global economy.

Established in May 1990, Zenith Bank began operations in July 1990. The bank became a public limited company on June 17, 2004, and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004, following a successful initial public offering (IPO). In 2013, the bank listed $850 million worth of shares at $6.80 each on the London Stock Exchange (LSE). Headquartered in Lagos, Nigeria, Zenith Bank has over 400 branches and business offices across all states of Nigeria and the Federal Capital Territory (FCT).

Founded by Jim Ovia in 1990, Zenith Bank has grown into one of Africa’s leading financial institutions. The bank’s philosophy is to remain customer-centric with a clear understanding of its market and environment. Zenith Bank’s excellent performance has earned numerous awards, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the 14th consecutive year in the 2023 Top 1000 World Banks Ranking, published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020 and 2022; and Most Sustainable Bank, Nigeria, in the International Banker 2024 Banking Awards.

In March 2007, Zenith Bank was licensed by the Financial Services Authority (FSA) of the United Kingdom to establish Zenith Bank (UK) Limited. The bank also has subsidiaries in Ghana, Sierra Leone, The Gambia, and a representative office in China. The bank plans to expand further into Africa, Europe, and Asia.

Zenith Bank has been a pioneer in digital banking in Nigeria, deploying Information and Communication Technology (ICT) infrastructure to create innovative products that meet customer needs. The bank is a leader in deploying various banking technologies, and the Zenith brand is synonymous with state-of-the-art banking technologies. Driven by excellence and global best practices, the bank combines vision, banking expertise, and cutting-edge technology to create products and services that meet customer expectations, enable businesses to thrive, and grow customer wealth.

As Zenith Bank prepares to launch its capital-raising drive and complete its transition to a holding company structure, these initiatives are expected to position the bank to explore emerging market opportunities, enhance its digital and retail banking initiatives, and deliver superior value to stakeholders.